- History of companies

-

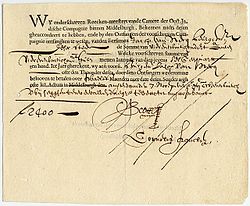

An allegory of tulip mania by Hendrik Gerritsz Pot, circa 1640. Flora, the goddess of flowers, is blown by the wind and rides with a tippler, money changers, and a two faced woman. They are followed by dissolute Haarlem weavers, on their way to destruction in the sea.

An allegory of tulip mania by Hendrik Gerritsz Pot, circa 1640. Flora, the goddess of flowers, is blown by the wind and rides with a tippler, money changers, and a two faced woman. They are followed by dissolute Haarlem weavers, on their way to destruction in the sea.

The history of companies stretches back to Roman times, and deals principally with associations of people formed to run a business, but also for charitable or leisure purposes. A corporation is one kind of company, which means an entity that has separate legal personality from the people who carry out its activities or have rights to its property. Originally, corporations were solely able to be established through an act of the state, for example through royal charter or an act of Parliament.

It was only in the mid nineteenth century, the first being through the Joint Stock Companies Act 1856 in the United Kingdom, that private individuals could through a simple registration procedure be considered to have established a corporation with limited liability. Companies today dominate economic life in all developed countries and in the global economy.

Contents

Early companies

The word "corporation" derives from corpus, the Latin word for body. Entities which carried on business and were the subjects of legal rights were found in ancient Rome, and the Maurya Empire in ancient India.[1] In medieval Europe, churches became incorporated, as did local governments, such as the Pope and the City of London Corporation. The point was that the incorporation would survive longer than the lives of any particular member, existing in perpetuity. The alleged oldest commercial corporation in the world, the Stora Kopparberg mining community in Falun, Sweden, obtained a charter from King Magnus Eriksson in 1347.

In medieval times traders would do business through common law constructs, such as partnerships. Whenever people acted together with a view to profit, the law deemed that a partnership arose. Early guilds and livery companies were also often involved in the regulation of competition between traders.

Renaissance and mercantilism

Many European nations chartered corporations to lead colonial ventures, such as the Dutch East India Company or the Hudson's Bay Company, and these corporations came to play a large part in the history of colonialism and mercantilism. Acting under a charter sanctioned by the Dutch government, the Vereenigde Oost-Indische Compagnie (VOC), or the Dutch East India Company, defeated Portuguese forces and established itself in the Moluccan Islands in order to profit from the European demand for spices. Investors in the VOC were issued paper certificates as proof of share ownership, and were able to trade their shares on the original Amsterdam stock exchange. Shareholders are also explicitly granted limited liability in the company's royal charter.[2]

As England sought to build a mercantile Empire, the government created corporations under a Royal Charter or an Act of Parliament with the grant of a monopoly over a specified territory. The best known example, established in 1600, was the British East India Company. Queen Elizabeth I granted it the exclusive right to trade with all countries to the east of the Cape of Good Hope. Corporations at this time would essentially act on the government's behalf, bringing in revenue from its exploits abroad. Subsequently the Company became increasingly integrated with British military and colonial policy, just as most UK corporations were essentially dependent on the British navy's ability to control trade routes.

- Company of Saint George, Ufficio di San Giorgio in Genoa or Casa di San Giorgio, founded in 1407 in the Republic of Genoa

- State concession theory of companies, or the "Oktroisystem" (in German)

- Case of Sutton's Hospital (1612) 77 ER 960

Eighteenth century

Main article: South Sea BubbleA similar chartered company, the South Sea Company, was established in 1711 to trade in the Spanish South American colonies, but met with less success. The South Sea Company's monopoly rights were supposedly backed by the Treaty of Utrecht, signed in 1713 as a settlement following the War of Spanish Succession, which gave the United Kingdom an assiento to trade in the region for thirty years. In fact the Spanish remained hostile and let only one ship a year enter. Unaware of the problems, investors in the UK, enticed by extravagant promises of profit from company promoters bought thousands of shares. By 1717, the South Sea Company was so wealthy (still having done no real business) that it assumed the public debt of the UK government. This accelerated the inflation of the share price further, as did the Bubble Act 1720, which (possibly with the motive of protecting the South Sea Company from competition) prohibited the establishment of any companies without a Royal Charter. The share price rose so rapidly that people began buying shares merely in order to sell them at a higher price, which in turn led to higher share prices. This was the first speculative bubble the country had seen, but by the end of 1720, the bubble had "burst", and the share price sank from £1000 to under £100. As bankruptcies and recriminations ricocheted through government and high society, the mood against corporations, and errant directors, was bitter.

Stewart Kyd, the author of the first treatise on corporate law in English, defined a corporation as,

"a collection of many individuals united into one body, under a special denomination, having perpetual succession under an artificial form, and vested, by policy of the law, with the capacity of acting, in several respects, as an individual, particularly of taking and granting property, of contracting obligations, and of suing and being sued, of enjoying privileges and immunities in common, and of exercising a variety of political rights, more or less extensive, according to the design of its institution, or the powers conferred upon it, either at the time of its creation, or at any subsequent period of its existence."[3]

Due to the late 18th century abandonment of mercantilist economic theory and the rise of classical liberalism and laissez-faire economic theory due to a revolution in economics led by Adam Smith and other economists, corporations transitioned from being government or guild affiliated entities to being public and private economic entities free of government direction. In 1776, Adam Smith wrote in the Wealth of Nations that mass corporate activity could not match private entrepreneurship, because people in charge of others' money would not exercise as much care as they would with their own.[4]

- The Charitable Corporation v Sutton (1742) 26 ER 642

- Attorney General v Davy (1741) 2 Atk 212

Modern company law

France

Main article: French company lawIn the wake of the French Revolution in 1791, the right to free registration for all private companies was proclaimed. There was a boom in registrations, but this was followed by a bust in 1793. The law was reversed until 1796 when the principle of free incorporation was established again.

The law was consolidated in Napoleon's Code de commerce of 1807 using a concession system.[5] While previously public companies with special privileges were created by a special act of the state, the Code allowed the companies to be formed according to general company law rules. Specific state permission was still required. Article 33 recognised limited liability for members.[6] The Code de commerce was applicable outside France in Baden and the Prussian Rhine province, and it came to serve as a model for all later European public company statutes. The first German public company statute was the Prussian Act of 1843, five years after the Prussian Act on railway enterprises of 1838. Under the Loi sur les Sociétés of 1867 France adopted a system for free registration of companies.[7]

Germany

Main article: German company lawIn Germany, through most of the 19th century the Kommanditgesellschaft (société en commandite in France) was the typical form of business organisation. A "KG" had at least one member with unlimited liability, but other investors' liability is limited to their contribution. A special concession was not required for setting up this company. In 1861 the Allgemeines Deutsches Handelsgesetzbuch or the General Commercial Code for all of Germany, as well as Austria, was enacted, which devoted a section to joint stock companies. This allowed incorporation with limited liability. Companies would be constituted with a single board of directors, though they had the option of a two tiered board system, involving shareholders appointing a supervisory board, which could in turn elected the management board.[8]

There were updates to the Handelsgesetzbuch in the "Aktiennovelle von 1870" (New Company Act 1870),[9] and again in 1884.[10] The 1884 reform mandated that companies have a two-tier board, with the justification that free registration rather than a system of state concession, meant a supervisory board was needed to take over the state's monitoring role.[11] The members of the supervisory board were not allowed to serve on the management board. However, shareholders could still directly elect management board members if they so wished.[12] Further reforms to the Handelsgesetzbuch in 1897, but without changing the basic structure.[13]

- Preußischen Gesetz von 1843, a unified company law in Prussia

- Gewerbefreiheit or economic/business freedom

United Kingdom

Main articles: UK company law and UK company law historyThe UK Bubble Act 1720's prohibition on establishing companies remained in force until its repeal in 1825. By this point the Industrial Revolution had gathered pace, pressing for legal change to facilitate business activity. The Bubble Companies, etc. Act 1825[14] was the beginning of gradual lifting on restrictions, though business ventures such as those chronicled by Charles Dickens in Martin Chuzzlewit under primitive companies legislation were often scams. Without cohesive regulation, proverbial operations like the "Anglo-Bengalee Disinterested Loan and Life Assurance Company" would be undercapitalised ventures promising no hope of success except for richly paid promoters.[15] Then in 1843, William Gladstone took chairmanship of a Parliamentary Committee on Joint Stock Companies, which led to the Joint Stock Companies Act 1844.[16] For the first time it was possible for ordinary people through a simple registration procedure to incorporate. The advantage of establishing a company as a separate legal person was mainly administrative, as a unified entity under which the rights and duties of all investors and managers could be channeled.

The most important development, was the Limited Liability Act 1855, which allowed investors to limit their liability in the event of business failure to the amount they invested in the company. These two features - a simple registration procedure and limited liability - were subsequently codified in the first modern company law Act, the Joint Stock Companies Act 1856. This was subsequently consolidated with a number of other statutes in the Companies Act 1862, which remained in force for the late century, up to and including the time of the decision in Salomon v A Salomon & Co Ltd.[17]

United States

Main articles: US corporate law and US antitrustBy the end of the eighteenth century, there were about 300 incorporated companies in the United States, most of them providing public services, and only eight manufacturing companies.[18] New York was the first state to enact a corporate statute in 1811 and did so with a system for simple registration and limited liability. However this was only available for manufacturing companies.[19] which was followed by New Jersey in 1816. In 1819, the U.S. Supreme Court granted corporations rights they had not previously recognized in Trustees of Dartmouth College v. Woodward.[20] Corporate charters were deemed "inviolable," and not subject to arbitrary amendment or abolition by state governments. Until the 1830s, when more states began to enact general corporate laws, most companies were incorporated by a special bill adopted by legislature, however even until the late century many companies preferred to seek a special legislative act for incorporation to attain privileges or monopolies.

Corporate charters remained regulated by the states. Forming a corporation usually required an act of legislature. Investors generally had to be given an equal say in corporate governance, and corporations were required to comply with the purposes expressed in their charters. (Andrew Carnegie formed his steel operation as a limited partnership, and John D. Rockefeller set up Standard Oil as a trust). Eventually, state governments started to have more permissive corporate laws. New Jersey was the first state to adopt an "enabling" corporate law, with the goal of attracting more business to the state. Delaware’s first corporation law was enacted in 1883.

In 1890 Congress passes the Sherman Antitrust Act, which criminalised cartels that acted in restraint of trade. While case law developed, and eventually began cracking down on the normal practices of businesses who cooperated or colluded with one another, corporations could not acquire stock in one another's businesses. However in 1898 when New Jersey changed its law to allow this. In 1899 Delaware mirrored this,[21] saying that corporations could acquire stock in other corporations registered in Delaware and exercise all rights. This made Delaware increasingly an attactive places for businesses to incorporate holding companies, through which they could retain control over large operations without sanction under the Sherman Act. As antitrust law continued to tighten, companies integrated through mergers fully.

Limited liability was a matter of state law, and in Delaware up until 1967, it was left to the certificate of incorporation to stipulate “whether the private property of the stockholders... shall be subject to the payment of corporate debts, and if so, to what extent.” In California, limited liability was recognised as late as 1931.

Modern corporations

Early twentieth century

Following formal acts of corporate law, the rise of classical liberalism, and the abandonment of mercantilism, corporations increasingly became public and private entities free from government control. The 20th century saw a rise of corporation law across the world.

- Clayton Act of 1914

- Since 1929 Delaware required a simple majority, not qualified majority, of shareholder votes for asset mergers (sale, lease, or other disposal of any or all of the corporation’s assets)

- Celler-Kefauver Act of 1950

- Betriebsverfassungsgesetz or works councils

- History of competition law

Great Depression

- United States

- New Deal

- Securities and Exchange Act

- AA Berle and GC Means, The Modern Corporation and Private Property (1932)

- Germany

Under the Nazi government of Adolf Hitler companies were made considerably less democratic in a reform of 1937. From then, shareholders could not elect managers directly, and managers could only be removed "for an important reason", directors would serve five year terms, and were under a duty to serve the Gemeinwohl or "general good", rather than prior understanding of the company as its employees and shareholders.[22]

Post war

- Nationalisation

- Cohen Report and Companies Act 1948

- Mitbestimmungsgesetz and Bullock Report

- DGCL and Race to the bottom

Privatisation and deregulation

Starting in the 1980s, many countries with large state-owned corporations moved toward privatization, the selling of publicly owned services and enterprises to private individuals and corporations. Deregulation, reducing the regulation of corporate activity, has often historically accompanied privatization and is part of laissez-faire policy. Another major postwar shift was toward the development of conglomerates, in which large corporations purchased smaller corporations to expand their industrial base. Japanese firms developed a horizontal conglomeration model, the keiretsu, which was later duplicated in other countries as well.

- Privatisation

- Big Bang (financial markets)

- Cadbury Report

- Long Term Capital Management

- Enron

- Sarbanes-Oxley Act

- Global financial crisis

See also

- List of oldest companies

- UK company law

- US corporate law

- Corporation

- Tulip Mania

- South Sea Bubble

Notes

- ^ VS Khanna, 'The Economic History of the Corporate Form in Ancient India' (2005) University of Michigan.

- ^ Om Prakash, European Commercial Enterprise in Pre-Colonial India (Cambridge University Press, Cambridge 1998).

- ^ S Kyd, A Treatise on the Law of Corporations (1793-1794)

- ^ A Smith, An Inquiry into the Nature and Causes of the Wealth of Nations (1776) Book V, ch 1, para 107

- ^ See the French Wikipedia

- ^ Art. 33 Code de Commerce, adopted by Law No. 2804, November 1807, Bull. des Lois No. 164 (1808), 161-299 (France).

- ^ See Law of July 24, 1867 amending the Code de Commerce, Bull. des Lois 11e S., B. 1513, n. 15, 328 p. 94

- ^ Allgemeines Deutsches Handelsgesetzbuch §225

- ^ C Windbichler, Gesellschaftsrecht (22nd edn Beck 2009) 298, stating the law was concerned mostly with formal requirements for company structures. The following "Gründerzeit" (period of company foundations) saw a lot of abuse since there were few protections for shareholders or creditors over how their money was used.

- ^ On the latter, see Gesetz betreffend die Kommenditgesellschaften auf Aktien und die Aktiengesellschaften (AktG) v. 31.7.1884 (RGBl. S. 123-70), which served as a model in Japan

- ^ See Handelsgesetzbuch §209; and see P Hommelhoff and W Schubert, Hundert Jahre Modernes Aktienrecht (1985); KJ Hopt, 'Zur Funktion des Aufsichtsrats im Verhältnis von Industrie und Bankensystem' or 'Law and the Formation of the Big Enterprises in the 19th and 20th Centuries' in N Horn & J Kocka (eds) (1979) 227

- ^ Handelsgesetzbuch § 236

- ^ C Windbichler, Gesellschaftsrecht (22nd edn Beck 2009) 299

- ^ See Bubble Companies, etc. Act 1825, 6 Geo 4, c 91

- ^ See C Dickens, Martin Chuzzlewit (1843) ch 27

- ^ Report of the Parliamentary Committee on Joint Stock Companies (1844) British Parliamentary Papers vol VII

- ^ Salomon v A Salomon & Co Ltd [1897] AC 22

- ^ See PI Blumberg, The Multinational Challenge to Corporation Law (1993) 6

- ^ See An Act Relative to Incorporations for Manufacturing Purposes, of 22 March 1811, NY Laws, 34th Session (1811) chap LXCII at 151.

- ^ 17 U.S. 518 (1819).

- ^ DGCL 1883 §23 (17 Del Laws, c 147 p. 212, 14 March 1883) stated that shares held in other corporations did not confer voting rights and acquisition of shares in other companies required explicit authorisation. Changed in DGCL 1889 (21 Del Laws, c 273, p. 444, 10 March 1899). Any corporation created under the DGCL could purchase, hold, sell, or assign shares of other corporations.

- ^ Gesetz über Aktiengesellschaften und Kommanditgesellschaften auf Aktien (AktG), v. 30.1.1937 (RGBl. I S. 29-165) §23, on directors serving for five years.

References

- Articles

- MJ Roe, 'Backlash' (1998) 98 Columbia Law Review 217

- PG Mahoney, 'Contract or Concession? An Essay on the History of Corporate Law' (2000) 34 Ga. Law Review 873

- SM O'Connor, 'Be Careful What You Wish For: How Accountants and Congress Created the Problem of Auditor Independence' (2004) 45 B.C.L. Rev. 741

- VS Khanna, 'The Economic History of the Corporate Form in Ancient India' (2005) University of Michigan.

- English

- PI Blumberg, The Multinational Challenge to Corporation Law (1993)

- PL Davies and LCB Gower, Principles of Modern Company Law (6th edn Sweet and Maxwell 1997) chapters 2-4

- P Frentrop, A History of Corporate Governance 1602–2002 (Brussels et al, 2003)

- S Kyd, A Treatise on the Law of Corporations (1793–1794)

- J Micklethwait and A Wooldridge, The company: A short history of a revolutionary idea (Modern Library 2003)

- German

- H Coing, Handbuch der Quellen und Literatur der neueren europäischen Privatrechtsgeschichte (1986) vol III/3

- N Horn and J Kocka (eds), Recht und Entwicklung der Großunternehmen im 19. und frühen 20. Jahrhundert (Göttingen, 1979)

- KJ Hopt, ‘Ideelle und wirtschaftliche Grundlagen der Aktien-, Bank- und Börsenrechtsentwicklung im 19. Jahrhundert’, in Helmut Coing and Walter Wilhelm (eds), Wissenschaft und Kodifikation des Privatrechts im 19. Jahrhundert, vol V: Geld und Banken (Frankfurt, 1980)

- K Lehmann, Die geschichtliche Entwicklung des Aktienrechts bis zum Code de Commerce (Berlin, 1895)

External links

Categories:- Corporations law

- Legal history

- Company histories

- Companies

Wikimedia Foundation. 2010.