- Euro Plus Pact

-

The Euro-Plus Pact, also initially called the Competitiveness Pact or later the Pact for the Euro,[1] is a 2011 plan in which the member states of the European Union make concrete commitments to a list of political reforms which are intended to improve the fiscal strength and competitiveness of each country. The plan was advocated by the French and German governments for more widespread adoption by other Eurozone countries. As such it is designed as a more stringent successor to the Stability and Growth Pact, which has not been implemented consistently. The pact has been controversial not only because of the closed way in which it was developed but also for the goals that it postulates. It was adopted in March 2011 and uses the EU's Open Method of Coordination.

Contents

Euro-Plus Pact

The Euro-Plus Pact came with four broad strategic goals along with more specific strategies for addressing these goals. The four goals are:

- fostering competitiveness

- fostering employment

- contributing to the sustainability of public finances

- reinforcing financial stability.

An additional fifth issue is:[2]

- tax policy coordination

These goals are intended to be addressed by all member countries of the pact, unless a Member State can "show that action is not needed" in this area. While the pact comes with specific strategies these are not seen as compulsory, specifically the pact states:

"The choice of the specific policy actions necessary to achieve the common objectives remains the responsibility of each country, but particular attention will be paid to the set of possible measures mentioned below."

The aims and strategies of the pact are to be updated yearly with the following procedure.

"...each year participating Member States will agree at the highest level on a set of concrete actions to be achieved within 12 months."

Competitiveness

This area of the pact is the same as addressed in Abolishing Wage Indexation. It will be evaluated by the national Unit Labour Cost (ULC), a quantitative measure of wage costs, and is to be addressed by both reducing the cost of labour as well as increasing productivity. Labour costs are to be reduced by reforming the "degree of centralisation in the bargaining process", the "indexation mechanisms" as well as decreasing wages in the public sector. Productivity is to be increased by deregulating industries as well as improving infrastructure and education.

Employment

The goal will be evaluated by quantitative measures of long term and youth unemployment rates, and labour participation rates. This aim is to be achieved by promoting the “flexicurity” model as well as "lowering taxes on labour" and "taking measures to facilitate the participation of second earners in the work force".

Public finances

Indicated as being the most important aim of the pact this objective is to be addressed by increasing the "sustainability of pensions, health care and social benefits" as well as implementing "national fiscal rules." Increasing the sustainability of pensions, health care and social benefits means limiting the liability of the government to a more manageable level, this will be done by "limiting early retirement ... in the age tranche above 55" as well as implementing "schemes and using targeted incentives to employ older workers" reducing the burden on pension systems.

One of the most stringent conditions of the pact is given with respect to fiscal rules:

"Participating Member States commit to translating EU fiscal rules as set out in the Stability and Growth Pact into national legislation."

When implementing a balanced budget amendment "Member States will retain the choice of the specific national legal vehicle to be used" provided that it has a "sufficiently strong binding" condition and a "durable nature." The pact recommends a constitutional amendment or framework law that is formulated as either a "debt brake, rule related to the primary balance or an expenditure rule." Additional it should "ensure fiscal discipline at both national and sub-national levels" in case these have autonomy to issue debt or other liabilities.

Financial stability

The Financial stability will be measured quantitatively with respect to the "level of private debt for banks, households and non-financial firms." With assistance from the President of the European Systemic Risk Board countries are expected to put into place "national legislation" to resolve these in case they exceed benchmark levels.

Tax policy coordination

Developing a common corporate tax base could be a revenue neutral way forward to ensure consistency among national tax systems while respecting national tax strategies, and to contribute to fiscal sustainability and the competitiveness of European businesses. Tax policy coordination is also expected to strengthen best practices sharing and fight against fraud and tax evasion. Direct taxation remains a national competence.[2]

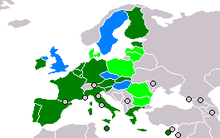

Participation

On 25 March 2011 the proposal for economic measures and cooperation was adopted by the European Council and included as participants without any caveats the Eurozone member states as well as Bulgaria, Denmark, Latvia, Lithuania, Poland and Romania.[2] The EU members not participating currently are Czech Republic, Hungary, Sweden and the United Kingdom, all for different reasons.[3]

Progress

According to the latest Euro Plus Monitor report 2011, published on 15 November, many eurozone member countries are now rapidly reforming to increase the competitiveness of their economies. The authors write that "Many of those countries most in need to adjust [...] are now making the greatest progress towards restoring their fiscal balance and external competitiveness". Greece, Ireland, Malta and Spain are among the top five reformers among 17 countries included in the report.[4]

The original plan: The Competitiveness Pact

The original plan was announced by Germany and France in February 2011 and called for six policy changes to be set[5] as well as for a monitoring system to be implemented to ensure progress. The six objectives are: abolishing wage indexation, raising pension ages, creating a common base for corporate tax and adopting debt brakes. In the following sections the motivation for and criticism of each objective is summarized.

- Abolishing wage indexation

Wage indexation is the process of adjusting wages to compensate for inflation, which reduces the value of money over time. Abolish indexation would allow for real wages to decrease increasing the competitiveness of countries as it becomes less expensive to employ people. Understandably this policy objective has been called into question by some governments such as Belgium as it reduces people's purchasing power.[6][7][8][9]

- Raising pension ages

In countries with "pay as you go" pension systems, as most European countries have, raising pension ages has a very profound impact on government revenue as people who continue working will also pay taxes instead of requiring them. This too is a controversial proposal as can be seen in the 2010 French pension reform strikes.

- Creating a common base for corporate taxes

Main article: Tax harmonizationCreating a "common base" is perceived by some as a first step in a process of unifying tax rates and as such has been opposed by countries such as Ireland, which have low corporate tax rates. The opinion of the European Commission is that having a common rules for calculating of the base amount over which the different national tax rates are applied is beneficial for the enterprises since it will reduce the administrative burden and costs of maintaining compliance with 27 different rule sets for corporate bookkeeping.

- Adopting debt brakes

The word "debt brake" comes from the German "Schuldenbremse", an amendment to the constitution legally limiting the size of sovereign debt countries are allowed to run. These have been implemented in Switzerland in 2003 and in Germany in 2010.[10] Debt brakes can vary in strictness and details of the intended implementation are not yet clear, but the motivation for this rule is to create a legally binding policy instead of the current budget guidelines on deficits which have been not been implemented by member countries.

Criticism

The plan has been criticised for impinging on the sovereignty of countries due to its authority to set policy in areas that were previously under the national. The reforms that the pact contain have also been criticised as being too harsh, or conversely called into question for not being strict enough in is requirements to implement reform.[11]

See also

- Enhanced co-operation

- European sovereign debt crisis

- Treaty of Lisbon

References

- ^ "The euro and the European Union: Can Angela Merkel hold Europe together?". The Economist. 10 March 2011. http://www.economist.com/node/18332786. Retrieved 26 April 2011.

- ^ a b c "25 March 2011 Council decisions" (PDF). http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/120296.pdf. Retrieved 26 April 2011.

- ^ "Pact for the Euro: What's in a name?". The Economist blogs. http://www.economist.com/blogs/charlemagne/2011/03/pact_euro. Retrieved 26 April 2011.

- ^ "Euro Plus Monitor 2011". The Lisbon Council. 15 November 2011. http://www.lisboncouncil.net//index.php?option=com_downloads&id=557. Retrieved 17 November 2011.

- ^ "Charlemagne: The divisiveness pact". The Economist. 18 October 2010. http://www.economist.com/research/articlesBySubject/displaystory.cfm?subjectid=3856661&story_id=18330371. Retrieved 26 April 2011.

- ^ http://fr.euronews.net/2011/03/10/la-defiance-vis-a-vis-d-une-possible-desindexation-des-salaires-sur-l-inflation/

- ^ http://it.euronews.net/2011/03/10/salari-e-inflazione-dilemma-al-vertice-dell-eurozona/

- ^ http://www.ilfoglio.it/soloqui/7644

- ^ http://mobile.ilsole24ore.com/sole24orem/post/959?url=07db77ae861d4b6332e6d7e1a43a41d3

- ^ "Schuldenbremse – Wikipedia" (in (German)). De.wikipedia.org. 17 April 2011. http://de.wikipedia.org/wiki/Schuldenbremse. Retrieved 26 April 2011.

- ^ "Pact for the euro: Tough talk, soft conditions? , vox – Research-based policy analysis and commentary from leading economists". Voxeu.org. http://www.voxeu.org/index.php?q=node/6206. Retrieved 26 April 2011.

External links

- Euro Pact Plus: http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/120296.pdf

- Competitivness Pact:http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/119809.pdf

- http://www.bbc.co.uk/news/world-europe-12368401

Categories:- Eurozone fiscal matters

Wikimedia Foundation. 2010.