- International status and usage of the euro

-

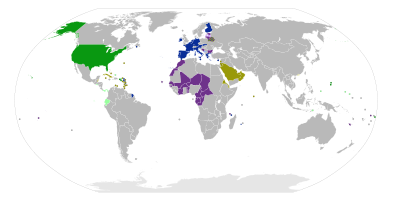

Worldwide use of the euro and US$:

Worldwide use of the euro and US$: External adopters of the euroCurrencies pegged to the euroCurrencies pegged to the euro within narrow bandUnited StatesExternal adopters of the US dollarCurrencies pegged to the US dollarCurrencies pegged to the US dollar within narrow bandNote that the Belarusian ruble is pegged to the Euro, Russian Ruble and U.S. Dollar in a currency basket.

External adopters of the euroCurrencies pegged to the euroCurrencies pegged to the euro within narrow bandUnited StatesExternal adopters of the US dollarCurrencies pegged to the US dollarCurrencies pegged to the US dollar within narrow bandNote that the Belarusian ruble is pegged to the Euro, Russian Ruble and U.S. Dollar in a currency basket.The international status and usage of the euro has grown since its launch in 1999. When the euro formally replaced 12 currencies on 1 January 2002, it inherited their use in territories such as Montenegro and they replaced minor currencies tied to the pre-euro currencies such as in Monaco. Three small states have been given a formal right to use the euro, and to mint their own coins, but all other usage has been unofficial outside the eurozone (the EU states who have adopted the euro). With or without an agreement these countries, unlike those in the eurozone, do not participate in the European Central Bank or the Euro Group.

Its international usage has also grown in its usage as a trading currency, acting as an economic or political[citation needed] alternative to using the United States dollar. Its increasing usage in this sense has led to it becoming the only significant challenger to the US dollar as the world main reserve currency.

Contents

International adoption

States with issuing rights

State Adopted Agreement Pop.

Monaco 1 January 1999 31 December 1998[1] 32,671

San Marino 1 January 1999 31 December 1998[2] 29,615

Vatican City 1 January 1999 31 December 1998[3] 800 Several states outside the EU have adopted the euro as their currency. For formal adoption, including the right to mint their own coins, a monetary agreement must be concluded. Agreements have been concluded with Monaco, San Marino, and Vatican City. All of these states previously used versions of yielded member state currencies. The Vatican and San Marino had their currencies pegged to the Italian lira (Vatican and Sammarinese lira) and Monaco used the Monegasque franc, which was pegged on a 1:1 basis to the French franc.[4][5]

These countries concluded agreements with EU and member states (Italy in the case of San Marino and Vatican City and France in the case of Monaco) allowing them to use and mint a limited amount of euro (with their own national symbols on the obverse side) to be valid throughout the Eurozone. They do not however print banknotes. A similar agreement is being negotiated with Andorra (see below).[4][5]

Territories outside EU

There are a number of French territories and a UK sovereign military base outside the EU that have adopted the euro as their currency, while other territories have local currencies usually pegged to the euro. Agreements were concluded for two overseas territories of France. Saint-Pierre-et-Miquelon off the coast of Canada, and Mayotte in the Indian Ocean are outside the EU but have been allowed to use the euro as their currency. However as they are under French jurisdiction they cannot mint their own coins.[5][6]

With the adoption of the euro in Cyprus, the Sovereign Base Areas of Akrotiri and Dhekelia, which had previously used the Cypriot pound, also adopted the euro. The base areas are overseas territories of the United Kingdom, but are outside of the EU and under military jurisdiction. However their laws and currency have been aligned with those of the Republic of Cyprus, leading to the euro's adoption in the two areas.[7]

On 22 February 2007, Saint Barthélemy and Saint Martin were politically separated from Guadeloupe to form two new French overseas collectivities; their status in the EU was briefly in a state of legal limbo until ratification of the Treaty of Lisbon reaffirmed both territories remained fully included in the EU. The euro continued to be used in both territories through this time period without incident. Saint Barthélemy will withdraw from the EU and become one of the EU Overseas Countries and Territories. That's why an agreement about Euro usage there was signed.[8]

On 29 March 2009 the referendum in Mayotte resulted in it becoming an integral part of France. The process of aligning with the laws of France (and thus EU) isn't finished and that's why there still isn't an EU Council decision to change Mayotte status from an OCT to an OMR where EU laws apply without separate agreements.

Territory Adopted Agreement Pop. Notes

Akrotiri and Dhekelia 1 January 2008 Via treaty[9] 14,500 Sovereign military base

Mayotte 1 January 1999 31 December 1998[10] 186,452 Became an integral part of France, and hence the EU and the Eurozone, in 2011.

Saint Pierre and Miquelon 1 January 1999 31 December 1998[11] 6,125

French Southern and Antarctic Lands 1 January 1999 None 140 Other users

Further information: Kosovo and the euro, Montenegro and the euro, Andorran euro coins, and DollarisationState/Territory Adopted Seeking Pop. Notes

Andorra 1 January 2002 Agreement[12] 82,000 Seeking issuing agreement

Kosovo[a] 1 January 2002[13] Membership 2,100,000 Seeking membership

Montenegro 1 January 2002 Membership 684,736 Seeking membership Andorra does not have an official currency and hence no specific euro coins. It previously used the French franc and Spanish peseta as de facto legal tender currency. There has never been a monetary arrangement with either Spain or France; however, the EU and Andorra are currently in negotiations regarding the official status of the euro in Andorra. According to Andorran officials, Andorra would have minted its own euro coins for the first time in 2006; as of May 2010[update], this has not yet happened, partially due to stalling regarding banking secrecy in December 2005.[14]

Montenegro and Kosovo[a] have also used the euro since its launch, as they previously used the German mark rather than the Yugoslav dinar. This was due to political concerns that Serbia would use the currency to destabilise these provinces (Montenegro was then in a union with Serbia) so they received western help in adopting and using the mark (though there was no restriction on the use of the dinar or any other currency). They switched to the euro when the mark was replaced but have no agreement with the ECB; rather the country depends only on euros already in circulation.[15][16] Kosovo also still uses the Serbian dinar in areas mainly populated by the Serbian minority.[17]

The use of the euro in Montenegro and Kosovo has helped stabilise their economies, and for this reason the adoption of the euro by small states has been encouraged by former Finance Commissioner Joaquín Almunia. Former European Central Bank President Jean-Claude Trichet has stated the ECB – which does not grant representation to those who unilaterally adopt the euro – neither supports nor deters those wishing to use the currency.

Usage in states with another official currency

In various countries the Euro is accepted by some merchants albeit not being official currency there. Additionally sometimes it's used for pricing purposes even if the actual payments are made in the official currency (i.e. for real estates).

EU members outside the Eurozone

The Swedish town Höganäs, does since 1 January 2009 generally allow shop payments in euro alongside of the Swedish krona.[18] Widespread usage, though unofficial, is also present in towns such as Haparanda, on the border with Finland. Euro is often accepted in shops near other borders to the Eurozone, like the western borders of Poland, Czech republic and Hungary.

Northern Cyprus

EU law and treaties application to Northern Cyprus is currently suspended.[19] Its territory is claimed by the Republic of Cyprus, one of the EU member states, but currently Northern Cyprus is under Turkish Republic of Northern Cyprus (TRNC) control. TRNC isn't recognised by the Republic of Cyprus (which claims jurisdiction over the whole island), the European Union or any country other than Turkey. EU law would start to apply in Northern Cyprus if it comes under control of the Republic of Cyprus (if the Cyprus dispute is resolved trough unification), whose official legal tender is the Euro.

Presently, the TRNC government has declared the Turkish lira to be its legal tender. Nevertheless usage of the Euro in Northern Cyprus is seen as a way to boost intra-Cypriot trade and reduce dependence on Turkey[20] and is widely accepted.[21][22] With the use of the euro across the border helping economic integration, the arrival of the euro has been hailed as a major advance in solidifying peace and unification on the island. The Cypriot euro coins, using the Greek and Turkish languages, have been designed to avoid any bias towards any particular area of the island.[23]

Some in the Turkish Republic of Northern Cyprus (TRNC) have called for the unilateral adoption of the euro by that state (similarly to those states).[15]

Others cases

The Euro is used officially at some other places outside EU. The Istanbul-Atatürk Airport uses euro as the official currency in shops, and uses exchange rates for some other currencies such as Turkish Lira and US dollar.

Trading currency

In 1998, Cuba announced that it would replace the US$ with the euro as its official currency for the purposes of international trading.[24] On 1 December 2002, North Korea did the same. (Its internal currency, the wŏn, is not convertible and thus cannot be used to purchase foreign goods. The euro also enjoys popularity domestically, especially among resident foreigners.) Syria followed suit in 2006.[25]

In 2000, President of Iraq Saddam Hussein began the sale of his country's oil denominated in euros rather than dollars since the majority of Iraqi oil trade was with the EU, India and China rather than the United States. Several other oil producing countries stated they would follow suit but when Iraq was invaded in 2003, the new US interim administration immediately switched all sales of oil back to the US dollar. Since then, Iran has maintained its policy of demanding euros from the sale of oil towards Europe and Asia, and plans to set up an oil exchange denominated in euro.

Pegged currencies

Currently there are several currencies pegged to the euro, some with fluctuation bands around a central rate and others with no fluctuations allowed around the central rate. This can be seen as a safety measure, especially for currencies of areas with weak economies. The euro is seen as a stable currency, i.e. there are no dramatic appreciations or depreciations of its value that might suddenly damage the economy or harm trade. Thus it provides security to traders and people holding that currency.

In 2011 the Swiss franc was rapidly appreciating against the euro, harming its exports to the eurozone. In response, Switzerland implemented a cap to the Swiss franc's value. This was not so much a peg, as they were merely limiting its highest value and not its lowest.

State Population Area Code National currency Central rate Pegged since Fluctuation band Formerly pegged to EMU

Bosnia and Herzegovina 4,590,310 51,129 km² BAM B&H convertible mark 1.955830 1 January 1999 0.00% DEM (from 21 November 1995)

Bulgaria 7,385,367 110,910 km² BGN Bulgarian lev 1.955830 1 January 1999 0.00% DEM (from 1997)

Comoros 690,948 2,170 km² KMF Comorian franc 491.9678 1 January 1999 0.00% FRF (from 23 November 1979)

Denmark 5,475,791 43,094 km² DKK Danish krone 7.460380 1 January 1999 2.25% XEU ERM2

Cape Verde 499,796 4,033 km² CVE Cape Verdean escudo 110.2650 1 January 1999 0.00% PTE (from middle of 1998)

Latvia 2,307,000 64,589 km² LVL Latvian lat 0.702804 1 January 2005 15.0% (de facto 1%) ERM2

Lithuania 3,483,972 65,303 km² LTL Lithuanian litas 3.452800 2 February 2002 15.0% (de facto 0%) US$ (from 1 April 1994) ERM2

Morocco

(inc. West Sahara)33,657,259 712,550 km² MAD Moroccan dirham ≈ 10.0 1 January 1999 –

São Tomé e Príncipe 163,000 1,001 km² STD São Tomé and Príncipe dobra 24,500 1 January 2010 0.00%

XOF currency union;

Benin

Burkina Faso

Côte d'Ivoire

Guinea-Bissau

Mali

Niger

Senegal

Togo70,931,986 3,269,077 km² XOF West African CFA franc 655.957 1 January 1999 0.00% FRF (from 17 October 1948)

XAF currency union;

Cameroon

Central African Republic

Chad

Republic of the Congo

Equatorial Guinea

Gabon38,750,133 2,757,528 km² XAF Central African CFA franc 655.9570 1 January 1999 0.00% FRF (from 17 October 1948)

XPF currency union;

French Polynesia

New Caledonia

Wallis and Futuna520,938 19,597 km² XPF CFP franc 119.3317 1 January 1999 0.00% FRF (from 21 October 1949) The Bulgarian Lev is pegged to the euro through a currency board.[citation needed] Estonia and Lithuania joined ERM II on 28 June 2004, Cyprus, Latvia and Malta joined on 2 May 2005; these currencies had been pegged to the Euro before joining ERM II.[citation needed] Malta was pegged to a basket of currencies where the Euro had a 70% weighting.[citation needed] As part of ERM II, the currencies have a fluctuation band of ±15%. However, some states have committed to a tighter fluctation band.[citation needed]

Convertible mark is the currency of Bosnia and Herzegovina and it was fixed to 1 German Mark when it was introduced on the basis of the Dayton agreement; consequently after introduction of the euro, the Convertible mark uses the German-mark-to-euro rate at 1.95583 BAM per euro.

Reserve currency status

The euro is a major global reserve currency, sharing that status with the U.S. dollar (USD), which continues to be the primary reserve of most commercial and central banks.[26]

Since its introduction, the euro has been the second most widely held international reserve currency after the U.S. dollar. The euro inherited this status from the German mark, and since its introduction, it has increased its standing, mostly at the expense of the dollar. The increase of 4.4% in 2002 is due to the introduction of euro banknotes and coins in January 2002.

The possibility of the euro's becoming the first international reserve currency is now widely debated among economists.[27] Former Federal Reserve Chairman Alan Greenspan gave his opinion in September 2007 that the euro could indeed replace the U.S. dollar as the world's primary reserve currency. He said it is "absolutely conceivable that the euro will replace the dollar as reserve currency, or will be traded as an equally important reserve currency."[28] Additionally, there has been suggestion that recent weakness of the US dollar might encourage parties to increase their reserves in euro at the expense of the dollar.[29] In the second term of 2007, euro as a reserve currency had reached a record level of 25.6% (a +0.8% increase from the year before) – at the expense of US dollar, which dropped to 64.8% (a drop of 1.3% from the year before).[30] By the end of 2007, shares of euro increased to 26.4% as the dollar slumped to its lowest level since records began in 1999, 63.8%.[31]

The exact situation varies from country to country, for example those with dollar pegs have greater dollar reserves and those with euro pegs have greater euro reserves.[32] In 2009, Russia's foreign reserves in euro exceed dollar reserves for the first time; Russia held 47.5% (up from 42% in 2008) in euro and 41.5% (down from 47%) in dollar leading the Central Bank of Russia to announce the euro had become the reserve currency of Russia.[33] The usage of the euro is particularly strong in Eastern Europe, not surpassingly in those that have joined the EU, with 54.8% of all loans in Bulgaria, and 85.2% in Latvia, being issued in euro rather than the local currencies.[34] The following table shows central banks allocated reserves in euros and US dollar. The impact of the growing unallocated reserves on the shares of euros vs US dollar has been studied only very recently [35].

Currency composition of official foreign exchange reserves '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 Latest Data

'11 Quarter IIUS dollar 59.0% 62.1% 65.2% 69.3% 70.9% 70.5% 70.7% 66.5% 65.8% 65.9% 66.4% 65.7% 64.1% 64.1% 62.1% 61.8% 60.2% Euro 17.9% 18.8% 19.8% 24.2% 25.3% 24.9% 24.3% 25.2% 26.3% 26.4% 27.6% 25.9% 26.7% German mark 15.8% 14.7% 14.5% 13.8% French franc 2.4% 1.8% 1.4% 1.6% Pound sterling 2.1% 2.7% 2.6% 2.7% 2.9% 2.8% 2.7% 2.9% 2.6% 3.3% 3.6% 4.2% 4.7% 4.0% 4.3% 4.0% 4.2% Japanese yen 6.8% 6.7% 5.8% 6.2% 6.4% 6.3% 5.2% 4.5% 4.1% 3.9% 3.7% 3.2% 2.9% 3.1% 2.9% 3.8% 3.9% Swiss franc 0.3% 0.2% 0.4% 0.3% 0.2% 0.3% 0.3% 0.4% 0.2% 0.2% 0.1% 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% Other 13.6% 11.7% 10.2% 6.1% 1.6% 1.4% 1.2% 1.4% 1.9% 1.8% 1.9% 1.5% 1.8% 2.2% 3.1% 4.5% 4.9% Sources: 1995-1999, 2006-2010 IMF: Currency Composition of Official Foreign Exchange Reserves

Sources: 1999-2005 ECB: The Accumulation of Foreign ReservesA currency is attractive for international transactions when it demonstrates stability, a well-developed financial market to trade the currency, and acceptability to others. While the euro has made substantial progress, a few challenges undermine the ascension of the euro as a major reserve currency. Persistent excessive budget deficits of some member nations, economically weak new members, conservatism of financial markets, and inertia or path dependence are important factors keeping the euro as a junior international currency to the U.S. dollar. However, at the same time, the USD has increasingly suffered from a double deficit and has its own concerns.

As the euro becomes a new reserve currency, Eurozone governments will enjoy substantial benefits. Since money is an interest-free loan to the issuing government by the holder of the currency, foreign reserves act as a subsidy to the country minting the currency (see Seigniorage). However, reserve status also holds risks, as the currency may become overvalued, hurting European exporters and potentially exposing the European economy to influence by external factors who hold large quantities of euros.[citation needed]

See also

- Reserve currency

- Dollarisation

- International use of the US dollar

Notes

a. ^ Kosovo is the subject of a territorial dispute between the Republic of Serbia and the self-proclaimed Republic of Kosovo. The latter declared independence on 17 February 2008, while Serbia claims it as part of its own sovereign territory. Its independence is recognised by 85 UN member states. References

- ^ By monetary agreement between France (acting for the EC) and Monaco

- ^ By monetary agreement between Italy (acting for the EC) and San Marino

- ^ By monetary agreement between Italy (acting for the EC) and Vatican city[1]

- ^ a b "Agreements on monetary relations (Monaco, San Marino, the Vatican and Andorra)". European Communities. 30 September 2004. http://europa.eu/scadplus/leg/en/lvb/l25040.htm. Retrieved 12 September 2006.

- ^ a b c The euro outside the euro area, Europa (web portal)

- ^ Agreements concerning the French territorial communities

- ^ Theodoulou, Michael (27 December 2007Euro reaches field that is for ever England, Times Online

- ^ Monetary agreement between the European Union and the French Republic on keeping the euro in Saint-Barthélemy following the amendment of its status with regard to the European Union (see [2])

- ^ By the third protocol to the Cyprus adhesion Treaty to EU and British local ordinance (see [3]).

- ^ By agreement of the EU Council (see [4]).

- ^ By agreement of the EU Council (see [5])

- ^ [6]

- ^ By UNMIK administration direction 1999/2 (see [7])

- ^ Boldt, Hans H. and Sant Julià de Lòria (15 November 2006). "Andorranische Euros nicht zu jedem Preis" (in German). Andorra-Intern. http://www.andorra-intern.com/news_2006/andorraeuros.htm. Retrieved 3 January 2007.

- ^ a b Euro used as legal tender in non-EU nations International Herald Tribune (1 January 2007)

- ^ KOUCHNER SIGNS REGULATION ON FOREIGN CURRENCY, UNMIK

- ^ Kosovo – Economic profile, Europa (web portal)

- ^ "BBC NEWS | Business | Swedish town aims to be 'euro-city'". News.bbc.co.uk. Page last updated at 06:46 GMT, Monday, 29 December 2008. http://news.bbc.co.uk/2/hi/business/7798060.stm. Retrieved 1 January 2009.

- ^ Protocol 10 to the Treaty of Accession 2003 (OJ L 236, 23.9.2003, p. 955).

- ^ Hadjicostis, Menelaos (30 December 2007) In north Cyprus, the Turkish lira is the official currency, but euro is embraced, International Herald Tribune

- ^ Cyprus and Malta adopt the euro BBC

- ^ Cyprus' isolated north will be enthusiastic – if unofficial – euro users

- ^ Smith, Helena (2 January 2008) Arrival of euro boosts Cyprus peace hopes, The Guardian

- ^ "Cuba to adopt Euro in foreign trade". BBC News. 8 November 1998. http://news.bbc.co.uk/1/hi/world/americas/210441.stm. Retrieved 2 January 2008.

- ^ "US row leads Syria to snub dollar". BBC News. 14 February 2006. http://news.bbc.co.uk/1/hi/business/4713622.stm. Retrieved 2 January 2008.

- ^ Currency Composition of Official Foreign Exchange Reserves (COFER)

- ^ "Will the Euro Eventually Surpass the Dollar As Leading International Reserve Currency?" (PDF). http://www.wage.wisc.edu/uploads/Working%20Papers/chinnfrankel_NBER_eurotopcurrency.pdf.

- ^ "Reuters". Euro could replace dollar as top currency – Greenspan. 17 September 2007. http://www.reuters.com/article/bondsNews/idUSL1771147920070917. Retrieved 17 September 2007.

- ^ ""American Gangster's Wad of Euros Signals U.S. Decline"". http://www.bloomberg.com/apps/news?pid=20601109&sid=azto7U.TmGX0&refer=exclusive.

- ^ ""Euro Rises on Speculation ECB's Trichet to Signal Higher Rates"". http://www.bloomberg.com/apps/news?pid=20601101&sid=afEneKf3hgw8&refer=japan.

- ^ Dollar's Share of Currency Reserves Falls, IMF Says (Update1) Bloomberg

- ^ Truman, Edwin M. (27 July 2009) It’s Time to Recognize Reserve Currency Realities, Peterson Institute for International Economics

- ^ Dollar stops being Russia's basic reserve currency, Pravda 19 May 2009

- ^ Robinson, Frances (8 July 2009) Euro Grows as Reserve Currency at Dollar’s Expense , Bloomberg

- ^ How to replace the world trade reference currency ? 6/26/2011

External links

International reach and expansion of the European Union Theory Reach ACP (Economic Partnership Agreements) · Association Agreement · Free trade agreements · Common Foreign and Security Policy (CFSP) · European Security and Defence Policy (ESDP) (missions) · European Economic Area · Stabilisation and Association Process · Europeanisation · High Representative (Bosnia) · International Civilian Representative (Kosovo)Partnerships Representation Assets European Union topics History - Pre-1945

- 1945–1957

- 1958–1972

- 1973–1993

- 1993–2004

- since 2004

Predecessors- European Coal and Steel Community (1951–2002)

- European Economic Community (1958–1993/2009)

- Euratom (1958–present)

- European Communities (1967–1993/2009)

- Justice and Home Affairs (1993–2009)

- Details

Governance - European Banking Authority

- Eurojust

- Europol

- Frontex

- Environment

- Reconstruction

- Disease Prevention and Control

- External Action Service

- Maritime Safety

Politics Law - Acquis

- Competition law

- Copyright law

- Directive

- Journal

- Government procurement

- Four freedoms (Labour mobility)

- Procedure

- Regulation

- Schengen Agreement

- Charter of Fundamental Rights

- Treaties (Opt-outs)

- Enhanced co-operation

- Mechanism for Cooperation and Verification

Geography - Borders

- Extreme points

- Largest municipalities

- Largest urban areas

- Largest metropolitan areas

- Larger Urban Zones

- Member States

- Special territories

- Regions

Economy - Currencies

- Common Agricultural Policy (CAP)

- Common Fisheries Policy

- Budget

- Euro

- Central Bank

- Investment Bank

- Investment Fund

- Eurozone

- Energy

- Regional development

- Single Market

- FTAs

- Solidarity Fund

- Transport (Galileo system)

Culture Lists Theory Categories:- Eurozone fiscal matters

- Economy of the European Union

Wikimedia Foundation. 2010.