- Oregon Ballot Measure 56 (2008)

-

Measure 56 Amends Constitution: Provides That May And November Property Tax Elections Are Decided By Majority Of Voters Voting. Election results Yes or no Votes Percentage  Yes

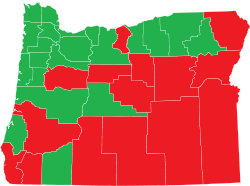

Yes1,251,478 77.42% No 364,993 22.58% Invalid or blank votes % Total votes 1,616,471 100.00% Voter turnout 85.7% Election results by county YesNoSource: Oregon Secretary of State [1]

Oregon Ballot Measure 56 or House Joint Resolution 15 (HJR 15) is a legislatively-referred constitutional amendment that enacted law which provides that property tax elections decided at May and November elections will be decided by a majority of voters who are voting in the relevant election.[2] It repealed the double majority requirement passed by the voters in the 1990s via Measures 47 and 50, which requires that, for non-general elections, all bond measures can pass only when a majority of registered voters turn out.The measure appeared on the November 4, 2008 general election ballot in Oregon and was passed with 77.42% of the vote.

Contents

Supporters

Measure 56 was supported by the Voting Matters Coalition, which included the League of Women Voters of Oregon, Human Services Coalition of Oregon, Ecumenical Ministries of Oregon, Basic Rights Oregon, Coalition for a Livable Future, Elders in Action, and Oregon PTA.

Official Voters' Pamphlet arguments in favor can be found at the Oregon Secretary of State's Online Voter Guide page.

Newspaper Endorsements

Here is how Oregon's major newspapers have endorsed on the measure:

Newspapers Yes No The Oregonian Yes Medford Mail-Tribune Yes Statesman Journal Yes Bend Bulletin Yes Portland Tribune Yes Eugene Register-Guard Yes Daily Astorian Yes East Oregonian Yes Corvallis Gazette Times Yes Coos Bay The World Yes Willamette Week Yes Yamhill Valley News Register Yes Gresham Outlook Yes Arguments in Favor

Notable arguments made in support of the measure included:

- Measure 56 restores the basic democratic principle that elections should be decided by a majority of the voters who take their time to cast a ballot. Giving non-voters as much—or more—power than the people who actually vote is inherently undemocratic and unfair.

- Under Oregon's Vote By Mail, there are no longer any "sneaker" elections—a ballot arrives in the mailbox of every voter any time there is an election, and when there are property tax proposals on the ballot, they are clearly and boldly marked on the front of the envelope. Voters who don't support a measure simply have to vote no.

- The "double majority" rule rewards people for not participating, which runs counter the idea of participatory democracy.

- Oregon has been plagued with budget crises since the passage of Measure 47 in 1996. Since then, the state has been working to reign in spending and work for a balanced budget, but it's come at the severe expense of important programs, such as education. Other options must be on the table and Measure 47 removes those options.

- Measure 47 is undemocratic and Measure 56 would eliminate that element of our electoral system. Functionally, everyone who chooses not to or cannot vote in a given election, votes NO on the measures that 47 applies to, even if they otherwise would have voted YES. This makes it extremely difficult to get such important measures passed and puts NO campaigns at an unfair advantage. Voter turnout in Oregon is rarely large enough to achieve a supermajority and it is notoriously low in midterm elections where a president is not being voted on. This is unfair and detrimental to our state

- A further effect of Measure 47 is to ensure that those who cannot vote but are still registered vote NO. If, for example, Registered Voter A passes away a month before a scheduled election, his death is not likely to be reflected on the voter roles and he will in effect vote NO from the grave. Or a convicted felon whose voting rights are relinquished may still show up on voter roles and Measure 47 effectively gives that felon the right to vote, but only to vote NO.

- Measure 56 will restore an important part of democracy in Oregon.

Opponents

Steve Buckstein of the non-partisan, non-profit Cascade Policy Institute wrote a commentary that says, "Critics of Oregon’s so-called 'double majority' rule say it isn’t democratic because a simple majority of those voting may not be able to pass a tax measure. But in reality, just 25% of registered voters can raise taxes under 'double-majority.' 'Double majority' is a sensible taxpayer safeguard that should be kept, and even strengthened."

Opposing Arguments

Notable arguments made in opposition to the measure included:

- Measure 56 would weaken the “double majority” rule (which has stopped numerous tax hikes) that requires 50 percent of registered voters to turn out and 50 percent of the votes in favor of a potential tax hike before it can take effect.

- Oregonians voted in 1996 and again in 1997 to place the double majority requirement on certain property tax elections into the state Constitution. In 1998 voters rejected an attempt by the legislature to repeal it. Now, the legislature has placed a similar measure on this November’s ballot. It will ask Oregonians to reverse a decision we’ve already made three times before.

- The double majority rule does not require a supermajority to pass any tax. In fact, the opposite is true. If only fifty percent of registered voters participate in a given election, and if just fifty percent plus one of those voters approve a property tax measure, simple math tells us that a mere 25 percent of all registered voters can impose that tax on all property owners in the jurisdiction. In effect, they can impose that tax on all renters, too, since landlords usually pass taxes on to their tenants in the form of higher rents.

- Before the rule was in place, taxes could be imposed by a mere 20 percent, or 10 percent, or even a smaller percentage of all registered voters. Now, it takes at least 25 percent of all registered voters to impose certain property taxes in other than a general election.

- Rather than repeal this sensible taxpayer safeguard, it might be more “democratic” to strengthen it, perhaps by requiring a majority of all registered voters to vote Yes before any tax can be imposed.

Notes

- ^ Bradbury, Bill (4 November 2008). "Official Results – November 4, 2008 General Election" (Website). Elections Division. Oregon Secretary of State. http://www.sos.state.or.us/elections/nov42008/g08results.html. Retrieved December 24, 2008.

- ^ Official ballot title and status of this initiative

External links

Topics in Oregon legislation Crime and sentencing Capital punishment · Measure 11 (1994) (mandatory minimum sentencing) · Measure 40 (1996) etc. (victims' rights) Abigail Scott Duniway was instrumental in establishing women's right to vote in Oregon.

Abigail Scott Duniway was instrumental in establishing women's right to vote in Oregon.

Elections and voting Gay rights Environment Land use Health care Minimum wage Taxation Tax revolt · Measure 5 (1990) (landmark tax law) · Measures 47 (1996) and 50 (1997) (adjusted Measure 5) · Kicker (tax rebate)Miscellaneous Influential people Background, further reading 2007 ← Oregon 2008 Elections → 2010 Categories:- Oregon 2008 ballot measures

- Taxation in Oregon

- Amendments to the Oregon Constitution

Wikimedia Foundation. 2010.