- Call option

-

This article is about financial options. For call options in general, see Option (law).

A call option, often simply labeled a "call", is a financial contract between two parties, the buyer and the seller of this type of option.[1] The buyer of the call option has the right, but not the obligation to buy an agreed quantity of a particular commodity or financial instrument (the underlying) from the seller of the option at a certain time (the expiration date) for a certain price (the strike price). The seller (or "writer") is obligated to sell the commodity or financial instrument should the buyer so decide. The buyer pays a fee (called a premium) for this right.

The buyer of a call option purchases it in the hope that the price of the underlying instrument will rise in the future. The seller of the option either expects that it will not, or is willing to give up some of the upside (profit) from a price rise in return for the premium (paid immediately) and retaining the opportunity to make a gain up to the strike price (see below for examples).

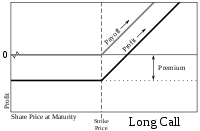

Call options are most profitable for the buyer when the underlying instrument moves up, making the price of the underlying instrument closer to, or above, the strike price. The call buyer believes it's likely the price of the underlying asset will rise by the exercise date. The risk is limited to the premium. The profit for the buyer can be very large, and is limited by how high the underlying instrument's spot price rises. When the price of the underlying instrument surpasses the strike price, the option is said to be "in the money".

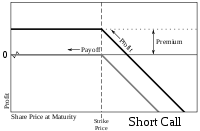

The call writer does not believe the price of the underlying security is likely to rise. The writer sells the call to collect the premium and does not receive any gain if the stock rises above the strike price.

The initial transaction in this context (buying/selling a call option) is not the supplying of a physical or financial asset (the underlying instrument). Rather it is the granting of the right to buy the underlying asset, in exchange for a fee — the option price or premium.

Exact specifications may differ depending on option style. A European call option allows the holder to exercise the option (i.e., to buy) only on the option expiration date. An American call option allows exercise at any time during the life of the option.

Call options can be purchased on many financial instruments other than stock in a corporation. Options can be purchased on futures on interest rates, for example (see interest rate cap), and on commodities like gold or crude oil. A tradeable call option should not be confused with either Incentive stock options or with a warrant. An incentive stock option, the option to buy stock in a particular company, is a right granted by a corporation to a particular person (typically executives) to purchase treasury stock. When an incentive stock option is exercised, new shares are issued. Incentive stock options are not traded on the open market. In contrast, when a call option is exercised, the underlying asset is transferred from one owner to another.

Contents

Example of a call option on a stock

An investor typically 'buys a call' when he expects the price of the underlying instrument will go above the call's 'strike price,' hopefully significantly so, before the call expires. The investor pays a non-refundable premium for the legal right to exercise the call at the strike price, meaning he can purchase the underlying instrument at the strike price. Typically, if the price of the underlying instrument has surpassed the strike price, the buyer pays the strike price to actually purchase the underlying instrument, and then sells the instrument and pockets the profit. Of course, the investor can also hold onto the underlying instrument, if he feels it will continue to climb even higher.

An investor typically 'writes a call' when he expects the price of the underlying instrument to stay below the call's strike price. The writer (seller) receives the premium up front as his or her profit. However, if the call buyer decides to exercise his option to buy, then the writer has the obligation to sell the underlying instrument at the strike price. Oftentimes the writer of the call does not actually own the underlying instrument, and must purchase it on the open market in order to be able to sell it to the buyer of the call. The seller of the call will lose the difference between his or her purchase price of the underlying instrument and the strike price. This risk can be huge if the underlying instrument skyrockets unexpectedly in price.

- The current price of ABC Corp stock is $45 per share, and investor 'Chris' expects it will go up significantly. Chris buys a call contract for 100 shares of ABC Corp from 'Steve,' who is the call writer/seller. The strike price for the contract is $50 per share, and Chris pays a premium up front of $5 per share, or $500 total. If ABC Corp does not go up, and Chris does not exercise the contract, then Chris has lost $500.

- ABC Corp stock subsequently goes up to $60 per share before the contract is expired. Chris exercises the call option by buying 100 shares of ABC from Steve for a total of $5,000. Chris then sells the stock on the market at market price for a total of $6,000. Chris has paid a $500 contract premium plus a stock cost of $5,000, for a total of $5,500. He has earned back $6,000, yielding a net profit of $500. Steve, however, did not do so well. Steve did not already own ABC Corp stock, so when Chris exercised the contract, Steve had to buy the stock on the open market for $6,000. Steve had already earned the $500 premium for the contract and $5,000 from Chris on selling the stock, so the total loss for Steve was $500.

- If, however, the ABC stock price drops to $40 per share by the time the contract expires, Chris will not exercise the option (i.e., Chris will not buy a stock at $50 per share from Steve when he can buy it on the open market at $40 per share). Chris loses his premium, a total of $500. Steve, however, keeps the premium with no other out-of-pocket expenses, making a profit of $500.

- The break-even stock price for Chris is $55 per share, i.e., the $50 per share for the call option price plus the $5 per share premium he paid for the option. If the stock reaches $55 per share when the option expires, Chris can recover his investment by exercising the option and buying 100 shares of ABC Corp stock from Steve at $50 per share, and then immediately selling those shares at the market price of $55. His total costs are then the $5 per share premium for the call option, plus $50 per share to buy the shares from Steve, for a total of $5,500. His total earnings are $55 per share sold, or $5,500 for 100 shares, yielding him a net $0. (Note that this does not take into account broker fees or other transaction costs.)

Example of valuing a stock option

A company issues an option for the right to buy their stock. An investor buys this option and hopes the stock goes higher so their option will increase in value.

- Theoretical option price = (current price + theoretical time/volatility premium) – strike price

Let's look at an actual example, PNC options for January 2012: http://finance.yahoo.com/q/op?s=PNC&m=2012-01.

- Strike Price – the price the investor can buy the stock at through the option.

- Symbol – like a stock symbol but for options it incorporates the date.

- Last – like the last stock price, it is the last price traded between two parties.

- Change – how much it went up and down today.

- Bid – what a person would bid for the option.

- Ask – what someone wants to sell the option.

- Vol – how many options traded today.

- Open Int – how many options are available, i.e. the option float.

Two notes 1) The Bid/Ask price is more relevant in ascertaining the value of the option then the last price since options are not frequently traded. Meaning the value is usually the Ask/Bid Price. 2) An option usually covers 100 shares. So the bid/ask price is multiplied by 100 to get the total cost.

Let's say we bought 3 PNC Strike $45, January 2012 options in August for $11.75. That means we paid $3,525 for the right to buy 300 (3*100) PNC shares now between now and January 2012.

The stock at that time traded at $50.65 meaning the theoretical call premium was $6.1 as shown by our formula: (current price + theoretical time/volatility premium) – strike price, (50.65 + 6.1 – 45 = 11.75).

Today the option is worth $19.45. With a theoretical call premium now of 73 cents. The call premium tends to go down as the option gets closer to the call date. And it goes down as the option price rises relative to the stock price, i.e. the 19.45 the option is now worth is 30% (19.45/ $64) of the price per PNC shares. In August it was 23% (11.75/$50.65). The lower percentage of the option's price is based on the stock's price, the more upside the investor has, therefore the investor will pay a premium for it.

This option could be used to buy 300 PNC shares today at $45, it can be sold on the option market for $19.45 or for $5,835 (19.45 * 3 options for 100 shares each). Or it can be held as the investor bets that the price will continue to increase. The investor must make a decision by January 2012: he will either have to sell the option or buy the 300 shares. If the stock price drops below the strike price on this date the investor will not exercise his right since it will be worthless.

Value of a call

This example leads to the following formal reasoning. Fix

an underlying financial instrument. Let Π be a call option for this instrument, purchased at time 0, expiring at time

an underlying financial instrument. Let Π be a call option for this instrument, purchased at time 0, expiring at time  , with exercise (strike) price

, with exercise (strike) price  ; and let

; and let ![S:[0,T]\to\mathbb{R}](5/a2594b18a33679a23752a2a2acf183c2.png) be the price of the underlying instrument.

be the price of the underlying instrument.Assume the owner of the option Π, wants to make no loss, and does not want to actually possess the underlying instrument,

. Then either (i) the person will exercise the option and purchase

. Then either (i) the person will exercise the option and purchase  , and then immediately sell it; or (ii) the person will not exercise the option (which subsequently becomes worthless). In (i), the pay-off would be − K + ST; in (ii) the pay-off would be 0. So if

, and then immediately sell it; or (ii) the person will not exercise the option (which subsequently becomes worthless). In (i), the pay-off would be − K + ST; in (ii) the pay-off would be 0. So if  (i) or (ii) occurs; if ST − K < 0 then (ii) occurs.

(i) or (ii) occurs; if ST − K < 0 then (ii) occurs.Hence the pay-off, i.e. the value of the call option at expiry, is

which is also written

or (ST − K) + .

or (ST − K) + .Price of options

Option values vary with the value of the underlying instrument over time. The price of the call contract must reflect the "likelihood" or chance of the call finishing "in-the-money." The call contract price generally will be higher when the contract has more time to expire (except in cases when a significant dividend is present) and when the underlying financial instrument shows more volatility. Determining this value is one of the central functions of financial mathematics. The most common method used is the Black-Scholes formula. Whatever the formula used, the buyer and seller must agree on the initial value (the premium or price of the call contract), otherwise the exchange (buy/sell) of the call will not take place. Adjustment to Call Option: When a call option is "in the money" i.e. when the buyer is making profit,he has many options.Some of them are as follows: 1.He can sell the call & book his profit 2.If he still feels that there is scope of making more money he can continue to hold the position. 3.If he is interested in holding the position but at the same time would like to have some protection,he can buy a protective "put" of the strike that suits him. 4.He can sell a call of higher strike price & convert the position into "call spread" & thus limiting his loss if the market reverses.

Similarly if the buyer is making loss on his position i,e the call is "out of the Money",he can make several adjustments to limit his loss or even make some profit.

Options

- Binary option

- Bond option

- Credit default option

- Exotic interest rate option

- Foreign exchange option

- Interest rate cap and floor

- Options on futures

- Stock option

- Swaption

- Warrant (finance)

See also

- Covered call

- Moneyness

- Naked call

- Naked put

- Option

- Option time value

- Option style

- Pre-emption right

- Put option

- Put-call parity

- Right of first refusal

References

- ^ Sullivan, arthur; Steven M. Sheffrin (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp. 288. ISBN 0-13-063085-3. http://www.pearsonschool.com/index.cfm?locator=PSZ3R9&PMDbSiteId=2781&PMDbSolutionId=6724&PMDbCategoryId=&PMDbProgramId=12881&level=4.

Categories:- Options

Wikimedia Foundation. 2010.