- Economic equilibrium

-

In economics, economic equilibrium is a state of the world where economic forces are balanced and in the absence of external influences the (equilibrium) values of economic variables will not change. It is the point at which quantity demanded and quantity supplied are equal.[1] Market equilibrium, for example, refers to a condition where a market price is established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers. This price is often called the equilibrium price or market clearing price and will tend not to change unless demand or supply change.

Contents

Properties of equilibrium

When the price is above the equifferent points of economic equilibrium. In most simple microeconomic stories of supply and demand in a market a static equilibrium is observed in a market; however, economic equilibrium can exist in non-market relationships and can be dynamic. Equilibrium may also be multi-market or general, as opposed to the partial equilibrium of a single market.

In economics, the term equilibrium is used to suggest a state of "balance" between supply forces and demand forces. For example, an increase in supply will disrupt the equilibrium, leading to lower prices. Eventually, a new equilibrium will be attained in most markets. Then, there will be no change in price or the amount of output bought and sold — until there is an exogenous shift in supply or demand (such as changes in technology or tastes). That is, there are no endogenous forces leading to the price or the quantity.

Not all economic equilibria are stable. For an equilibrium to be stable, a small deviation from equilibrium leads to economic forces that returns an economic sub-system toward the original equilibrium. For example, if a movement out of supply/demand equilibrium leads to an excess supply (surplus, or glut), that excess induces price declines which return the market to a situation where the quantity demanded equals the quantity supplied. If supply and demand curves intersect more than once, then both stable and unstable equilibria are found.

Most economists e.g., Paul Samuelson[2]:Ch.3,p.52 caution against attaching a normative meaning (value judgement) to the equilibrium price. For example, food markets may be in equilibrium at the same time that people are starving (because they cannot afford to pay the high equilibrium price). Indeed, this occurred during the Great Famine in Ireland in 1845–52, where food was exported though people were starving, due to the greater profits in selling to the English – the equilibrium price of the Irish-British market for potatoes was above the price that Irish farmers could afford, and thus (among other reasons) they starved.[3]

Interpretations

In most interpretations, classical economists such as Adam Smith maintained that the free market would tend towards economic equilibrium through the price mechanism. That is, any excess supply (market surplus or glut) would lead to price cuts, which decrease the quantity supplied (by reducing the incentive to produce and sell the product) and increase the quantity demanded (by offering consumers bargains), automatically abolishing the glut. Similarly, in an unfettered market, any excess demand (or shortage) would lead to price increases, reducing the quantity demanded (as customers are priced out of the market) and increasing in the quantity supplied (as the incentive to produce and sell a product rises). As before, the disequilibrium (here, the shortage) disappears. This automatic abolition of non-market-clearing situations distinguishes markets from central planning schemes, which often have a difficult time getting prices right and suffer from persistent shortages of goods and services[citation needed].

This view came under attack from at least two viewpoints. Modern mainstream economics points to cases where equilibrium does not correspond to market clearing (but instead to unemployment), as with the efficiency wage hypothesis in labor economics. In some ways parallel is the phenomenon of credit rationing, in which banks hold interest rates low to create an excess demand for loans, so they can pick and choose whom to lend to. Further, economic equilibrium can correspond with monopoly, where the monopolistic firm maintains an artificial shortage to prop up prices and to maximize profits. Finally, Keynesian macroeconomics points to underemployment equilibrium, where a surplus of labor (i.e., cyclical unemployment) co-exists for a long time with a shortage of aggregate demand.

On the other hand, the Austrian School and Joseph Schumpeter maintained that in the short term equilibrium is never attained as everyone was always trying to take advantage of the pricing system and so there was always some dynamism in the system. The free market's strength was not creating a static or a general equilibrium but instead in organising resources to meet individual desires and discovering the best methods to carry the economy forward.

Solving for equilibrium price

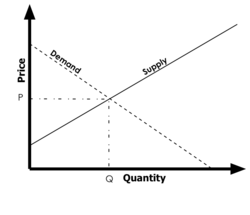

To solve for the equilibrium price, one must either plot the supply and demand curves, or solve for their equations being equal.

An example may be:

In the diagram, depicting simple set of supply and demand curves, the quantity demanded and supplied at price P are equal.

At any price above P supply exceeds demand, while at a price below P the quantity demanded exceeds that supplied. In other words, prices where demand and supply are out of balance are termed points of disequilibrium, creating shortages and oversupply. Changes in the conditions of demand or supply will shift the demand or supply curves. This will cause changes in the equilibrium price and quantity in the market.

Consider the following demand and supply schedule:

Price ($) Demand Supply 8.00 6,000 18,000 7.00 8,000 16,000 6.00 10,000 14,000 5.00 12,000 12,000 4.00 14,000 10,000 3.00 16,000 8,000 2.00 18,000 6,000 1.00 20,000 4,000 - The equilibrium price in the market is $5.00 where demand and supply are equal at 12,000 units

- If the current market price was $3.00 – there would be excess demand for 8,000 units, creating a shortage.

- If the current market price was $8.00 – there would be excess supply of 12,000 units.

When there is a shortage in the market we see that, to correct this disequilibrium, the price of the good will be increased back to a price of $5.00, thus lessening the quantity demanded and increasing the quantity supplied thus that the market is in balance.

When there is an oversupply of a good, such as when price is above $6.00, then we see that producers will decrease the price to increase the quantity demanded for the good, thus eliminating the excess and taking the market back to equilibrium.

Influences changing price

A change in equilibrium price may occur through a change in either the supply or demand schedules. For instance, starting from the above supply-demand configuration, an increased level of disposable income may produce a new demand schedule, such as the following:

Price ($) Demand Supply 8.00 10,000 18,000 7.00 12,000 16,000 6.00 14,000 14,000 5.00 16,000 12,000 4.00 18,000 10,000 3.00 20,000 8,000 2.00 22,000 6,000 1.00 24,000 4,000 Here we see that an increase in disposable income would increase the quantity demanded of the good by 4,000 units at each price. This increase in demand would have the effect of shifting the demand curve rightward. The result is a change in the price at which quantity supplied equals quantity demanded. In this case we see that the two now equal each other at an increased price of $6.00. Note that a decrease in disposable income would have the exact opposite effect on the market equilibrium .

We will also see similar behaviour in price when there is a change in the supply schedule, occurring through technological changes, or through changes in business costs. An increase in technological usage or know-how or a decrease in costs would have the effect of increasing the quantity supplied at each price, thus reducing the equilibrium price. On the other hand, a decrease in technology or increase in business costs will decrease the quantity supplied at each price, thus increasing equilibrium price.

The process of comparing two static equilibria to each other, as in the above example, is known as comparative statics. For example, since a rise in consumers' income leads to a higher price (and a decline in consumers' income leads to a fall in the price — in each case the two things change in the same direction), we say that the comparative static effect of consumer income on the price is positive. This is another way of saying that the total derivative of price with respect to consumer income is greater than zero.

Dynamic equilibrium

Whereas in a static equilibrium all quantities have unchanging values, in a dynamic equilibrium various quantities may all be growing at the same rate, leaving their ratios unchanging. For example, in the neoclassical growth model, the working population is growing at a rate which is exogenous (determined outside the model, by non-economic forces). In dynamic equilibrium, output and the physical capital stock also grow at that same rate, with output per worker and the capital stock per worker unchanging. Similarly, in models of inflation[4] a dynamic equilibrium would involve the price level, the nominal money supply, nominal wage rates, and all other nominal values growing at a single common rate, while all real values are unchanging, as is the inflation rate.

The process of comparing two dynamic equilibria to each other is known as comparative dynamics. For example, in the neoclassical growth model, starting from one dynamic equilibrium based in part on one particular saving rate, a permanent increase in the saving rate leads to a new dynamic equilibrium in which there are permanently higher capital per worker and productivity per worker, but an unchanged growth rate of output; so it is said that in this model the comparative dynamic effect of the saving rate on capital per worker is positive but the comparative dynamic effect of the saving rate on the output growth rate is zero.

See also

- Competitive equilibrium

- General equilibrium theory

- Partial equilibrium

- Nash equilibrium

- Labor theory of value

- Price

- Exchange value

- Supply and demand

- Microeconomics

- Real prices and ideal prices

- Prices of production

- Law of value

References

- ^ Hal R. Varian, Microeconomic Analysis, Third edn. Norton, New York 1992

- ^ Paul A. Samuelson (1947; Expanded ed. 1983), Foundations of Economic Analysis, Harvard University Press. ISBN 0-674-31301-1

- ^ See citations at Great Famine (Ireland): Food exports to England, including Cecil Woodham-Smith The Great Hunger; Ireland 1845–1849, and Christine Kinealy, 'Irish Famine: This Great Calamity and A Death-Dealing Famine'

- ^ Turnovsky, Stephen J. (2000), Methods of Macroeconomic Dynamics, MIT Press. ISBN 0262201232

Microeconomics Major topics Aggregation · Budget · Consumer · Convexity and non-convexity · Cost · Cost-benefit analysis · Distribution · Deadweight loss · Income–consumption curve · Duopoly · Equilibria · Economies of scale · Economies of scope · Elasticity · Exchange · Expected utility · Externality · Firms · General equilibria · Household · Information · Indifference curve · Intertemporal choice · Marginal cost · Market failure · Market structure · Monopoly · Monopsony · Oligopoly · Opportunity cost · Preferences · Prices · Production · Profit · Public goods · Returns to scale · Risk · Scarcity · Shortage · Social choice · Sunk costs · Supply & demand · Surplus · Uncertainty · Utility · WelfareRelated Behavioral · Business · Computational · Decision theory · Econometrics · Experimental · Game theory · Industrial organization · Mathematical economics · Microfoundations of Macroeconomics · Managerial · Operations research · OptimizationCategories:- Pricing

- Markets (customer bases)

Wikimedia Foundation. 2010.