- Economics of new nuclear power plants

-

The economics of new nuclear power plants is a controversial subject, since there are diverging views on this topic, and multi-billion dollar investments ride on the choice of an energy source. Nuclear power plants typically have high capital costs for building the plant, but low direct fuel costs (with much of the costs of fuel extraction, processing, use and long term storage externalized). Therefore, comparison with other power generation methods is strongly dependent on assumptions about construction timescales and capital financing for nuclear plants. Cost estimates also need to take into account plant decommissioning and nuclear waste storage costs. On the other hand measures to mitigate global warming, such as a carbon tax or carbon emissions trading, may favor the economics of nuclear power.

In recent years there has been a slowdown of electricity demand growth and financing has become more difficult, which has an impact on large projects such as nuclear reactors, with very large upfront costs and long project cycles which carry a large variety of risks.[1] In Eastern Europe, a number of long-established projects are struggling to find finance, notably Belene in Bulgaria and the additional reactors at Cernavoda in Romania, and some potential backers have pulled out.[1] Where cheap gas is available and its future supply relatively secure, this also poses a major problem for nuclear projects.[1]

Analysis of the economics of nuclear power must take into account who bears the risks of future uncertainties. To date all operating nuclear power plants were developed by state-owned or regulated utility monopolies[2] where many of the risks associated with construction costs, operating performance, fuel price, and other factors were borne by consumers rather than suppliers. Many countries have now liberalized the electricity market where these risks, and the risk of cheaper competitors emerging before capital costs are recovered, are borne by plant suppliers and operators rather than consumers, which leads to a significantly different evaluation of the economics of new nuclear power plants.[3]

Following the 2011 Fukushima Daiichi nuclear disaster, costs are likely to go up for currently operating and new nuclear power plants, due to increased requirements for on-site spent fuel management and elevated design basis threats.[4]

Sources of electricity in the U.S. in 2009.[5] Nuclear power accounts for 20% of electricity produced in the U.S.

Sources of electricity in the U.S. in 2009.[5] Nuclear power accounts for 20% of electricity produced in the U.S.

Contents

Capital costs

One of the big problems with nuclear power is the enormous upfront cost. These reactors are extremely expensive to build. While the returns may be very great, they're also very slow. It can sometimes take decades to recoup initial costs. Since many investors have a short attention span, they don't like to wait that long for their investment to pay off.[6]

Because of the large capital costs for nuclear power, and the relatively long construction period before revenue is returned, servicing the capital costs of a nuclear power plant is the most important factor determining the economic competitiveness of nuclear energy.[7] The investment can contribute about 70%[8] to 80%[9] of the costs of electricity. The discount rate chosen to cost a nuclear power plant's capital over its lifetime is arguably the most sensitive parameter to overall costs.[10]

The recent liberalization of the electricity market in many countries has made the economics of nuclear power generation less attractive.[11] Previously a monopolistic provider could guarantee output requirements decades into the future. Private generating companies now have to accept shorter output contracts and the risks of future lower-cost competition, so they desire a shorter return on investment period — this favours generation plant types with lower capital costs even if associated fuel costs are higher.[12] A further difficulty is that due to the large sunk costs but unpredictable future income from the liberalised electricity market, private capital is unlikely to be available on favourable terms, which is particularly significant for nuclear as it is capital-intensive.[13] Industry consensus is that a 5% discount rate is appropriate for plants operating in a regulated utility environment where revenues are guaranteed by captive markets, and 10% discount rate is appropriate for a competitive deregulated or merchant plant environment;[14] however the independent MIT study (2003) which used a more sophisticated finance model distinguishing equity and debt capital had a higher 11.5% average discount rate.[3]

Another consideration is that even though consumer demand is not guaranteed, nuclear is placed among the lowest operating cost options.[15] Once the plant is built, it has a distinct advantage over coal, gas, and other fuel based generation types in winning the momentary supply auctions, thereby resulting in operations at full reactor capacity. In this regard, typical Present Value (PV) calculations for risk-adjusted discount should be applied carefully, possibly approaching the guaranteed, captive market levels.[16]

Currently the smallest nuclear power plant that can be built is usually larger than other power plants, making it possible for a utility to build the other plants in smaller increments, or in areas of low power consumption.

As states are declining to finance nuclear power plants, the sector is now much more reliant on the commercial banking sector. According to research done by Dutch banking research group Profundo, commissioned by BankTrack, in 2008 private banks almost invested € 176 billion in the nuclear sector. Champions were BNP Paribas, with more than € 13,5 billion in nuclear investments and Citigroup and Barclays on par with both over € 11,4 billion in investments. Profundo added up investments in eighty companies in over 800 financial relationships with 124 banks in the following sectors: Construction, Electricity, Mining, the Nuclear fuel cycle and "Other".[17]

Recent construction cost estimates

2007 estimates have considerable uncertainty in overnight cost, and vary widely from $2,950/kWe (overnight cost) to a Moody's Investors Service conservative estimate of between $5,000 and $6,000/kWe (final or "all-in" cost).[18]

However, commodity prices shot up in 2008, and so all types of plants will be more expensive than previously calculated[19] In June 2008 Moody's estimated that the cost of installing new nuclear capacity in the U.S. might possibly exceed $7,000/kWe in final cost.[20]

The reported prices at six new pressurized water reactors are indicative of costs for that type of plant:[21]

- February 2008 — For two new AP1000 reactors at its Turkey Point site Florida Power & Light calculated overnight capital cost from $2444 to $3582 per kW, which were grossed up to include cooling towers, site works, land costs, transmission costs and risk management for total costs of $3108 to $4540 per kilowatt. Adding in finance charges increased the overall figures to $5780 to $8071 per kW.

- March 2008 — For two new AP1000 reactors in Florida Progress Energy announced that if built within 18 months of each other, the cost for the first would be $5144 per kilowatt and the second $3376/kW - total $9.4 billion. Including land, plant components, cooling towers, financing costs, license application, regulatory fees, initial fuel for two units, owner's costs, insurance and taxes, escalation and contingencies the total would be about $14 billion.

- May 2008 — For two new AP1000 reactors at the Virgil C. Summer Nuclear Generating Station in South Carolina South Carolina Electric and Gas Co. and Santee Cooper expected to pay $9.8 billion (which includes forecast inflation and owners' costs for site preparation, contingencies and project financing).

- November 2008 — For two new AP1000 reactors at its Lee site Duke Energy Carolinas raised the cost estimate to $11 billion, excluding finance and inflation, but apparently including other owners costs.

- November 2008 — For two new AP1000 reactors at its Bellefonte site TVA updated its estimates for overnight capital cost estimates ranged to $2516 to $4649/kW for a combined construction cost of $5.6 to 10.4 billion (total costs of $9.9 to $17.5 billion).

- April 2008 — Georgia Power Company reached a contract agreement for two AP1000 reactors to be built at Vogtle,[22] at an estimated final cost of $14 billion plus $3 billion for necessary transmission upgrades.[23]

In comparison, the AP1000 units already under construction in China have been reported with substantially lower costs due to significantly lower labour rates:

- In 2007, the reported cost for the first two AP1000 units under construction in China was $5.3 billion.

- In 2009, the published cost for 4 AP1000 reactors under construction in China was a total of $8 billion.

- in 2010, the Chinese nuclear commission expect construction costs would fall significantly once full scale mass production is underway. In addition, a domestic CAP1400 design based on the AP1000 is due to start construction in April 2013 with a scheduled start of 2017. Once the CAP1400 design has been proven, work is scheduled for a CAP1700 design with a target construction cost of $1000/kW

Cost overruns

Construction delays can add significantly to the cost of a plant. Because a power plant does not earn income during construction, longer construction times translate directly into higher finance charges. Modern nuclear power plants are planned for construction in four years or less (42 months for CANDU ACR-1000, 60 months from order to operation for an AP1000, 48 months from first concrete to operation for an EPR and 45 months for an ESBWR)[24] as opposed to over a decade for some previous plants. However, despite Japanese success with ABWRs, two of the four EPRs under construction (in Finland and France) are significantly behind schedule.[25]

In some countries (notably the U.S.), in the past unexpected changes in licensing, inspection and certification of nuclear power plants added delays and increased construction costs. However, the regulatory processes for siting, licensing, and constructing have been standardized, streamlining the construction of newer and safer designs.

In the U.S. many new regulations were put in place in the years before and again immediately after the Three Mile Island accident's partial meltdown, resulting in plant startup delays of many years. The NRC has new regulations in place now (see Combined Construction and Operating License), and the next plants will have NRC Final Design Approval before the customer buys them, and a Combined Construction and Operating License will be issued before construction starts, guaranteeing that if the plant is built as designed then it will be allowed to operate — thus avoiding lengthy hearings after completion.

In Japan and France, construction costs and delays are significantly diminished because of streamlined government licensing and certification procedures. In France, one model of reactor was type-certified, using a safety engineering process similar to the process used to certify aircraft models for safety. That is, rather than licensing individual reactors, the regulatory agency certified a particular design and its construction process to produce safe reactors. U.S. law permits type-licensing of reactors, a process which is being used on the AP1000 and the ESBWR.[26]

In Canada, cost overruns for the Darlington Nuclear Generating Station, largely due to delays and policy changes, are often cited by opponents of new reactors. Construction started in 1981 at an estimated cost of $7.4 Billion 1993-adjusted CAD, and finished in 1993 at a cost of $14.5 billion. 70% of the price increase was due to interest charges incurred due to delays imposed to postpone units 3 and 4, 46% inflation over a 4 year period and other changes in financial policy.[27] No new nuclear reactor has since been built in Canada, although a few have been and are undergoing refurbishment.

New nuclear power plants are not cheap. In the UK and the US cost overruns on nuclear plants contributed to the bankruptcies of several utility companies. In the US these losses helped usher in energy deregulation in the mid-’90s that saw rising electricity rates and power blackouts in California. When the UK began privatizing utilities its nuclear reactors "were so unprofitable they could not be sold". Eventually in 1996, the government gave them away. But the company that took them over, British Energy, had to be bailed out in 2004 to the extent of 3.4 billion pounds.[28]

Operating costs

In general, coal and nuclear plants have the same types of operating costs (operations and maintenance plus fuel costs). However, nuclear has lower fuel costs but higher operating and maintenance costs.[29]

Security

Unlike other power plants, nuclear plants must be carefully guarded against both attempted sabotage (generally with the goal considered to be causing a radiological accident, rather than just preventing the plant from operating) and possible theft of nuclear material. Thus security costs of both protecting the physical plant and the screening of workers must be considered. Some other forms of energy also require high security, like natural gas storage facilities and oil refineries.

Safety

Since nuclear reactors contain a core of highly radioactive fuel, and around that core a complex cooling system which is also significantly contaminated, nuclear power plant operators need to invest considerable resources in keeping these structures intact, functioning, and isolated from the environment. Whereas a conventional power plant can break down without large environmental effects, this has to be prevented at a nuclear power plant at all cost. Also, society at present doesn't perceive industrial risk as it used to in the early days of nuclear energy; it is now expected from nuclear plant operators that they will operate their plant with the highest safety standards, choosing the safest design, etc. In almost all cases that is precisely the most costly maintenance strategy and design.

Uranium

Nuclear plants require fissionable fuel. Generally, the fuel used is uranium, although other materials may be used (See MOX fuel). In 2005, prices on the world market averaged US$20/lb (US$44.09/kg). On 2007-04-19, prices reached US$113/lb (US$249.12/kg).[30] On 2008-7-2, the price had dropped to $59/lb.[31]

While the amounts of uranium used are a tiny fraction of the amounts of coal or oil used in conventional power plants, fuel costs account for about 28% of a nuclear plant's operating expenses.[30] Other recent sources cite lower fuel costs, such as 16%.[32] Doubling the price of uranium would add only 7% to the cost of electricity produced.

Currently, there are proposals to increase the numbers of nuclear power plants by 57% more reactors from the 435 currently in operation, according to John S. Herold's Ruppel. While it is unlikely all proposed plants will actually be completed, an increase in plants, combined with the current decline in supply, caused by flooding at some of the world's largest uranium mines, and speculators winning repositories in North America and Europe, means that prices are likely to increase. In addition, about 45% of the 2006 world supply of uranium came from old nuclear warheads, mostly Russian. At current supply and demand levels, those old stockpiles will be completely depleted by 2015.[30] However, this assumes that the Integral Fast Reactor design, indeed all fast breeder reactors, will not be used.[33]

Mining activity is growing rapidly, especially from smaller companies, but developing a uranium mine takes a long time, 10 years or more.[30] The world's present measured resources of uranium, economically recoverable at a price of 130 USD/kg according to the industry groups Organisation for Economic Co-operation and Development (OECD), Nuclear Energy Agency (NEA) and International Atomic Energy Agency (IAEA), are enough to last for "at least a century" at current consumption rates.[34]

In 2011, Benjamin K. Sovacool said that even on optimistic assumptions of fuel availability, global reserves of uranium will only support a 2% growth in nuclear power and will only be available for 70 years.[35] He said that uranium prices, like those of oil and natural gas, are highly volatile:

This means that uncertain uranium prices can have a grave impact on plant operating costs. Such price movement is hard to anticipate when, some of the countries now responsible for more than 30% of the world’s uranium production: Kazakhstan, Namibia, Niger, and Uzbekistan, are politically unstable.[35]

Specific costs

Waste disposal

Main article: Radioactive wasteAll nuclear plants produce radioactive waste. To pay for the cost of storing, transporting and disposing these wastes in a permanent location, in the United States a surcharge of a tenth of a cent per kilowatt-hour is added to electricity bills.[36] Roughly one percent of electrical utility bills in provinces using nuclear power are diverted to fund nuclear waste disposal in Canada.[37]

In 2009, the Obama administration announced that the Yucca Mountain nuclear waste repository would no longer be considered the answer for U.S. civilian nuclear waste. Currently, there is no plan for disposing of the waste and plants will be required to keep the waste on the plant premises indefinitely.

The disposal of low level waste reportedly costs around £2,000/m³ in the UK. High level waste costs somewhere between £67,000/m³ and £201,000/m³.[38] General division is 80%/20% of low level/high level waste,[39] and one reactor produces roughly 12 m³ of high level waste annually.[40]

In Canada, the NWMO was created in 2002 to oversee long term disposal of nuclear waste, and in 2007 adopted the Adapted Phased Management procedure. Long term management is subject to change based on technology and public opinion, but currently largely follows the recommendations for a centralized repository as first extensively outlined in by AECL in 1988. It was determined after extensive review that following these recommendations would safely isolate the waste from the biosphere. The location has not yet been determined, as is expected to cost between $9 and $13 billion CAD for construction and operation for 60–90 years, employing roughly a thousand people for the duration. Funding is available and has been collected since 1978 under the Canadian Nuclear Fuel Waste Management Program. Very long term monitoring requires less staff since high-level waste is less toxic than naturally occurring uranium ore deposits within a few centuries.[37]

Decommissioning

Main article: nuclear decommissioningAt the end of a nuclear plant's lifetime (estimated at between 40 and 60 years[citation needed]), the plant must be decommissioned. This entails either Dismantling, Safe Storage or Entombment. Operators are usually required to build up a fund to cover these costs while the plant is operating, to limit the financial risk from operator bankruptcy.

In the United States, the Nuclear Regulatory Commission (NRC) requires plants to finish the process within 60 years of closing. Since it may cost $300 million or more to shut down and decommission a plant, the NRC requires plant owners to set aside money when the plant is still operating to pay for the future shutdown costs.[41] In June 2009, the NRC published concerns that owners were not setting aside sufficient funds.[42]

Proliferation and terrorism

A 2011 report for the Union of Concerned Scientists stated that "the costs of preventing nuclear proliferation and terrorism should be recognized as negative externalities of civilian nuclear power, thoroughly evaluated, and integrated into economic assessments—just as global warming emissions are increasingly identified as a cost in the economics of coal-fired electricity".[43]

Accidents

The Union of Concerned Scientists have stated that "reactor owners ... have never been economically responsible for the full costs and risks of their operations. Instead, the public faces the prospect of severe losses in the event of any number of potential adverse scenarios, while private investors reap the rewards if nuclear plants are economically successful. For all practical purposes, nuclear power’s economic gains are privatized, while its risks are socialized".[44]

Any effort to construct a new nuclear facility around the world, whether an existing design or an experimental future design, must deal with NIMBY or NIABY objections. Because of the high profiles of the Three Mile Island accident and Chernobyl disaster, relatively few municipalities welcome a new nuclear reactor, processing plant, transportation route, or nuclear burial ground within their borders, and some have issued local ordinances prohibiting the locating of such facilities there.

Nancy Folbre, an economics professor at the University of Massachusetts, has questioned the economic viability of nuclear power following the 2011 Japanese nuclear accidents:

The proven dangers of nuclear power amplify the economic risks of expanding reliance on it. Indeed, the stronger regulation and improved safety features for nuclear reactors called for in the wake of the Japanese disaster will almost certainly require costly provisions that may price it out of the market.[45]

The cascade of problems at Fukushima, from one reactor to another, and from reactors to fuel storage pools, will affect the design, layout and ultimately the cost of future nuclear plants.[46]

Insurance

Globally nuclear liability risks resulting accidents are largely covered by the state, with only a small part of the risk carried by the private insurance industry. Worst case nuclear incident costs are so large that it would be difficult for the private insurance industry to carry the size of the risk, and the premium cost of full insurance would make nuclear energy uneconomic.[47]

Canada

In Canada, the Canadian Nuclear Liability Act[48] requires nuclear power plant operators to provide a maximum of $75 million dollars liability insurance coverage.

United Kingdom

In the UK, the Nuclear Installations Act of 1965 governs liability for nuclear damage for which a UK nuclear licensee is responsible. The limit for the operator is £140 million.[49]

United States

Insurance for nuclear or radiological incidents in the U.S. is organized by the Price-Anderson Nuclear Industries Indemnity Act. In general, nuclear power plants have private insurance and assessments that are pooled into a fund currently worth about $10 billion. Insurance claims beyond the fund's size would be organized by, and probably paid by, the U.S. government. In July 2005, Congress extended this Act to newer facilities. For full history, details and controversy, see Price-Anderson Nuclear Industries Indemnity Act.

Other

The Vienna Convention on Civil Liability for Nuclear Damage and the Paris Convention on Third Party Liability in the Field of Nuclear Energy put in place two similar international frameworks for nuclear liability.[50] The limits for the conventions vary. The Vienna convention was adapted in 2004 to increase the operator liability to €700 million per incident, but this modification is not yet ratified.[51]

Cost per kW·h

The cost per unit of electricity produced (kW·h) will vary according to country, depending on costs in the area, the regulatory regime and consequent financial and other risks, and the availability and cost of finance. Costs will also depend on geographic factors such as availability of cooling water, earthquake likelihood, and availability of suitable power grid connections. So it is not possible to accurately estimate costs on a global basis.

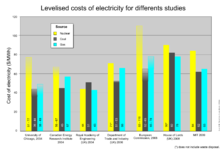

Various groups have attempted to estimate the economic cost for electricity generated by the most modern designs proposed for particular countries where these factors are generally fairly consistent.

In 2003, the Massachusetts Institute of Technology (MIT) issued a report entitled, "The Future of Nuclear Power". They estimated that new nuclear power in the US would cost 6.7 cents per kW·h.[3] However, the Energy Policy Act of 2005 includes a tax credit that should reduce that cost slightly.

The lifetime cost of new generating capacity in the United States was estimated in 2006 by the U.S. government (the 2007 report did not estimate costs). Nuclear power was estimated at 5.93 cents per kW·h. However, the "total overnight cost" for new nuclear was assumed to be $1,984 per kWe[52] — as seen above in Capital Costs, this figure is subject to debate.

A 2008 study based on historical outcomes in the U.S. said costs for nuclear power can be expected to run $0.25-.30 per kW·h.[53]

A 2008 study concluded that if carbon capture and storage was required then nuclear power would be the cheapest source of electricity even at $4,038/kW in overnight capital cost.[21]

In 2009, MIT updated its 2003 study, concluding that inflation and rising construction costs had increased the overnight cost of nuclear power plants to about $4,000/kWe, and thus increased the power cost to 8.4¢/kW·h.[9][54]

According to Benjamin K. Sovacool, the marginal levelized cost for "a 1,000-MWe facility built in 2009 would be 41.2 to 80.3 cents/kWh, presuming one actually takes into account construction, operation and fuel, reprocessing, waste storage, and decommissioning".[55]

Comparisons with other power sources

See also: Relative cost of electricity generated by different sourcesGenerally, a nuclear power plant is significantly more expensive to build than an equivalent coal-fueled or gas-fueled plant. However, coal is significantly more expensive than nuclear fuel, and natural gas significantly more expensive than coal — thus, capital costs aside, natural gas-generated power is the most expensive. Most forms of electricity generation produce some form of negative externality — costs imposed on third parties that are not directly paid by the producer — such as pollution which negatively affects the health of those near and downwind of the power plant, and generation costs often do not reflect these external costs.

A comparison of the "real" cost of various energy sources is complicated by several uncertainties:

- The cost of climate change through emissions of greenhouse gases is hard to estimate. Carbon taxes may be enacted, or carbon capture and storage may become mandatory.

- The cost of environmental damage caused by (fossil or renewable) energy sources, both through land use (whether for mining fuels or for power generation) and through air and water pollution and solid waste.

- The cost and political feasibility of disposal of the waste from reprocessed spent nuclear fuel is still not fully resolved. In the U.S., the ultimate disposal costs of spent nuclear fuel are assumed by the U.S. government after producers pay a fixed surcharge.

- Operating reserve requirements are different for different generation methods. When nuclear units shut down unexpectedly they tend to do so independently, so the "hot spinning reserve" must be at least the size of the largest unit (this partly makes nuclear power more suitable for large grids). On the other hand, many renewables are intermittent power sources and may shut down together if they depend on weather conditions, so the grid will require either back-up generation capability or large-scale storage if the portion of generation from these renewables is significant. (Some renewables such as hydroelectricity have a storage reservoir and can be used as reliable back-up power for other power sources.)

- Governmental instabilities in the next plant lifetime. New nuclear power plants are designed for a minimum of 60 years (50 for VVER-1200), and may be able to be refurbished. Likewise, the waste from reprocessed fuel remains dangerous for about this period.

- Actual plant lifetime (to date, no plant has been shut down due to maximum licensed lifetime being reached, or been refurbished).

- Due to the dominant role of initial construction cost and the multi-year construction time and planned lifetime, the interest rate for the capital required is of particularly high importance for estimating the total cost.

Several recent comparisons of the costs of plants are available (see below); however, commodity prices have shot up since they were completed, and so all types of plants will be more expensive than shown[19]

A UK Royal Academy of Engineering report in 2004 looked at electricity generation costs from new plants in the UK. In particular it aimed to develop "a robust approach to compare directly the costs of intermittent generation with more dependable sources of generation". This meant adding the cost of standby capacity for wind, as well as carbon values up to £30 (€45.44) per tonne CO2 for coal and gas. Wind power was calculated to be more than twice as expensive as nuclear power. Without a carbon tax, the cost of production through coal, nuclear and gas ranged £0.022–0.026/kW·h and coal gasification was £0.032/kW·h. When carbon tax was added (up to £0.025) coal came close to onshore wind (including back-up power) at £0.054/kW·h — offshore wind is £0.072/kW·h — nuclear power remained at £0.023/kW·h either way, as it produces negligible amounts of CO2. (Nuclear figures included estimated decommissioning costs.)[3][21][56]

However a much more detailed review of over 200 papers by the UK Energy Research Centre, on the issue of intermittency came to much lower costs about the cost of wind energy compared to nuclear energy.[57] A recent study shows the current generating costs of wind, nuclear and coal plant in the UK which stills shows nuclear the cheapest, but not by a great a margin.[58]

The lifetime cost of new generating capacity in the United States was estimated in 2006 by the U.S. government: wind cost was estimated at $55.80 per MW·h, coal (cheap in the U.S.) at $53.10, natural gas at $52.50 and nuclear at $59.30. However, the "total overnight cost" for new nuclear was assumed to be $1,984 per kWe[52] — as seen above in Capital Costs, this figure is subject to debate, as much higher cost was found for recent projects.[citation needed] Also, carbon taxes and backup power costs were not considered.[59]

A May 2008 study by the Congressional Budget Office concludes that a carbon tax of $45 per tonne of carbon dioxide would probably make nuclear power cost competitive against conventional fossil fuel for electricity generation.[60]

Estimates of total lifetime energy returned on energy invested vary greatly depending on the study. An overview can be found here (Table 2):[61]

The effect of subsidies is difficult to gauge, as some are indirect (such as research and development). A May 12, 2008 editorial in the Wall Street Journal stated, "For electricity generation, the EIA(Energy Information Administration, an office of the Department of Energy) concludes that solar energy is subsidized to the tune of $24.34 per megawatt hour, wind $23.37 and 'clean coal' $29.81. By contrast, normal coal receives 44 cents, natural gas a mere quarter, hydroelectric about 67 cents and nuclear power $1.59."[62]

However, the most important subsidies to the nuclear industry do not involve cash payments. Rather, they shift construction costs and operating risks from investors to taxpayers and ratepayers, burdening them with an array of risks including cost overruns, defaults to accidents, and nuclear waste management. This approach has remained remarkably consistent throughout the nuclear industry’s history, and distorts market choices that would otherwise favor less risky energy investments.[63]

In 2011, Benjamin K. Sovacool said that: "When the full nuclear fuel cycle is considered - not only reactors but also uranium mines and mills, enrichment facilities, spent fuel repositories, and decommissioning sites - nuclear power proves to be one of the costliest sources of energy".[64]

Other economic issues

Nuclear Power plants tend to be very competitive in areas where other fuel resources are not readily available — France, most notably, has almost no native supplies of fossil fuels.[65]

Making a massive investment of capital in a project with long-term recovery might impact a company's credit rating.[66]

A Council on Foreign Relations report on nuclear energy argues that a rapid expansion of nuclear power may create shortages in building materials such as reactor-quality concrete and steel, skilled workers and engineers, and safety controls by skilled inspectors. This would drive up current prices.[67] It may be easier to rapidly expand, for example, the number of coal power plants, without this having a large effect on current prices.

Load following capability

Some existing LWR type plants have limited ability to significantly vary their output to match changing demand[68] (called load-following). Other PWRs, as well as CANDU, BWR have load-following capability, which will allow them to fill more than baseline generation needs.

Some newer reactors also offer some form of enhanced load-following capability.[69] For example, the Areva EPR can slew its electrical output power between 990 and 1,650 MW at 82.5 MW per minute.[70] The number of companies that manufacture certain parts for nuclear reactors is limited, particularly the large forgings used for reactor vessels and steam systems. Only four companies (Japan Steel Works, China First Heavy Industries, Russia's OMX Izhora and Korea's Doosan Heavy Industries) currently manufacture pressure vessels for reactors of 1100 MWe or larger.[71][72] Some have suggested that this poses a bottleneck that could hamper expansion of nuclear power internationally,[23] however, some Western reactor designs require no steel pressure vessel such as CANDU derived reactors which rely on individual pressurized fuel channels. The large forgings for steam generators — although still very heavy — can be produced by a far larger number of suppliers.

Nuclear plants require 20–83 percent more cooling water than other power stations.[73] During times of abnormally high seasonal temperatures or drought it may be necessary for reactors drawing from small bodies of water to reduce power or shut down. Nuclear plants situated on large lakes, seas or oceans are not affected by seasonal temperature variations due to the thermal stability of large bodies of water.

New plants under construction

Main article: Nuclear renaissanceThe latest plant designs currently available for building are generally called generation III+ reactors. They include AREVA's European Pressurized Reactor (EPR), General Electric's ESBWR, Westinghouse's AP1000, and AECL's ACR-1000. Russia (see VVER), China (see CPR-1000), Japan, Korea and India all also have indigenous plant designs currently available for deployment.

In July 2008, Russia announced plans to allocate $40 billion from the state budget over the next 7 years for development of the nuclear energy sector and the nuclear industry. This will allow for construction of 26 major generating units in Russia by 2020 — about as many as were built in the entire Soviet period.[74]

As of 2008, the UK has indicated that it will take steps to encourage private operators to build new nuclear power plants in the coming years to meet projected energy needs as fossil fuel prices climb, however there would be no subsidies from the UK government for nuclear power.[75] An online calculator outlining UK means and limitations in meeting future energy needs illustrates the problem facing lawmakers and the public.[76]

As of 2011[update], the People's Republic of China has 13 nuclear power reactors spread out over 4 separate sites (Daya Bay, Qinshan, Tianwan, and Ling Ao), and 27 under construction.[77][78] China's National Development and Reform Commission has indicated the intention to raise the percentage of China's electricity produced by nuclear power from the current 1% to 6% by 2020 (compared to 20% in the USA as of 2008). This will require the current installed capacity of 10.2 GW to be increased to 70–80 GW (more than France at 63 GW).[79] However, rapid nuclear expansion may lead to a shortfall of fuel, equipment, qualified plant workers and safety inspectors.[80]

The 1600 MWe EPR reactor is being built in Olkiluoto Nuclear Power Plant, Finland. A joint effort of French AREVA and German Siemens AG, it will be the largest pressurized water reactor (PWR) in the world. The Olkiluoto project has been claimed to have benefited from various forms of government support and subsidies, including liability limitations, preferential financing rates, and export credit agency subsidies, but the European Commission's investigation didn't find anything illegal in the proceedings.[81][82] However, as of August 2009, the project is "more than three years behind schedule and at least 55% over budget, reaching a total cost estimate of €5 billion ($7 billion) or close to €3,100 ($4,400) per kilowatt".[83] Finnish electricity consumers interest group ElFi OY evaluated in 2007 the impact of Olkiluoto-3 to be slightly over 6%, or 3€/MWh, to the average market price of electricity within Nord Pool Spot. The delay is therefore costing the Nordic countries over 1.3 billion euros per year as the reactor would replace more expensive methods of production and lower the price of electricity.[84]

Four ABWRs are already in operation in Japan, and one more is being built in Japan and two in Taiwan.[85] South Korea plans to build 12 new nuclear reactors by 2022.[86]

Russia has begun building the world’s first floating nuclear power plant. The £100 million vessel, the Akademik Lomonosov, is the first of seven plants (70 MWe per ship) that Moscow says will bring vital energy resources to remote Russian regions.[87]

In December 2009 the United Arab Emirates declined both the American and French bids and awarded a contract for construction for four APR-1400s to a South Korean group including Korea Electric Power Corporation, Hyundai Engineering and Construction, Samsung and Doosan Heavy Industries.[88]

Following the Fukushima nuclear disaster in 2011, costs are likely to go up for currently operating and new nuclear power plants, due to increased requirements for on-site spent fuel management and elevated design basis threats.[4] After Fukushima, the International Energy Agency halved its estimate of additional nuclear generating capacity built by 2035.[89]

Many license applications filed with the U.S. Nuclear Regulatory Commission for proposed new reactors have been suspended or cancelled.[90][91] As of October 2011, plans for about 30 new reactors in the United States have been "whittled down to just four, despite the promise of large subsidies and President Barack Obama’s support of nuclear power, which he reaffirmed after Fukushima".[92] The only reactor currently under construction in America, at Watts Bar, Tennessee, was begun in 1973 and may be completed in 2012.[93][94] Matthew Wald from the New York Times has reported that "the nuclear renaissance is looking small and slow".[95]

See also

- Lists of nuclear disasters and radioactive incidents

- Light Water Reactor Sustainability Program

- Decommissioning nuclear facilities

- Nuclear power debate

- Generation IV reactor

- Renewable energy commercialization

- World Nuclear Industry Status Report

- Cost of electricity by source

References

- ^ a b c Kidd, Steve (January 21, 2011). "New reactors—more or less?". Nuclear Engineering International. http://www.neimagazine.com/story.asp?sectioncode=147&storyCode=2058653.

- ^ Ed Crooks (12 September 2010). "Nuclear: New dawn now seems limited to the east". Financial Times. http://www.ft.com/cms/s/0/ad15fcfe-bc71-11df-a42b-00144feab49a.html. Retrieved 12 September 2010.

- ^ a b c d The Future of Nuclear Power. Massachusetts Institute of Technology. 2003. ISBN 0-615-12420-8. http://web.mit.edu/nuclearpower/. Retrieved 2006-11-10

- ^ a b Massachusetts Institute of Technology (2011). "The Future of the Nuclear Fuel Cycle". p. xv. http://web.mit.edu/mitei/research/studies/documents/nuclear-fuel-cycle/The_Nuclear_Fuel_Cycle-all.pdf.

- ^ http://www.eia.doe.gov/cneaf/electricity/epm/table1_1.html

- ^ Indiviglio, Daniel (February 1, 2011). "Why Are New U.S. Nuclear Reactor Projects Fizzling?". The Atlantic. http://www.theatlantic.com/business/archive/2011/02/why-are-new-us-nuclear-reactor-projects-fizzling/70591/.

- ^ George S. Tolley and Donald W. Jones (August 2004). The Economic Future of Nuclear Power. University of Chicago. pp. 34. Archived from the original on 2007-04-15. http://web.archive.org/web/20070415012109/http://www.anl.gov/Special_Reports/NuclEconSumAug04.pdf#page=13. Retrieved 2007-05-05.

- ^ Malcolm Grimston (December 2005) (PDF). The Importance of Politics to Nuclear New Build. Royal Institute of International Affairs. pp. 34. http://www.chathamhouse.org.uk/pdf/research/sdp/Dec05nuclear.pdf#page=34. Retrieved 2006-11-17.[dead link]

- ^ a b Yangbo Du; John E. Parsons (May 2009) (PDF). Update on the Cost of Nuclear Power. Massachusetts Institute of Technology. http://web.mit.edu/ceepr/www/publications/workingpapers/2009-004.pdf. Retrieved 2009-05-19.

- ^ (PDF) The nuclear energy option in the UK. Parliamentary Office of Science and Technology. December 2003. Archived from the original on 2006-12-10. http://web.archive.org/web/20061210131520/http://www.parliament.uk/documents/upload/postpn208.pdf. Retrieved 2007-04-29.

- ^ Fabien A. Roques, William J. Nuttall and David M. Newbery (July 2006) (PDF). Using Probabilistic Analysis to Value Power Generation Investments under Uncertainty. University of Cambridge. Archived from the original on 2007-09-29. http://web.archive.org/web/20070929150044/http://www.electricitypolicy.org.uk/pubs/wp/eprg0619.pdf. Retrieved 2007-05-05.

- ^ Till Stenzel (September 2003). What does it mean to keep the nuclear option open in the UK?. Imperial College. pp. 16. Archived from the original on 2006-10-17. http://web.archive.org/web/20061017133431/http://www.parliament.uk/documents/upload/poste13.pdf#page=31. Retrieved 2006-11-17.

- ^ Electricity Generation Technologies: Performance and Cost Characteristics. Canadian Energy Research Institute. August 2005. http://www.energy.gov.on.ca/opareport/Part%204%20-%20Consulting%20Reports/Part%204.3%20CERI%20Report%20to%20OPA%20August%2024_2005_D.pdf#page=14. Retrieved 2007-04-28.

- ^ The Economic Modeling Working Group (2007-09-26) (PDF). Cost Estimating Guidelines for Generation IV Nuclear Energy Systems. Generation IV International Forum. http://www.gen-4.org/Technology/horizontal/EMWG_Guidelines.pdf#page=80. Retrieved 2008-04-19.

- ^ http://www.world-nuclear-news.org/C-STP_sets_new_US_operating_record-0710084.html

- ^ http://www.nei.org/newsandevents/recordlowcosts/

- ^ http://www.nuclearbanks.org

- ^ "How much?". Nuclear Engineering International. 2007-11-20. http://www.neimagazine.com/story.asp?storyCode=2047917. Retrieved 2007-12-26.

- ^ a b Nuclear Costs Explode.

- ^ Platts: A utility's credit quality could be negatively impacted by building a new nuclear power plant, 2 June 2008, Moody's Investors Service

- ^ a b c "The Economics of Nuclear Power". Information and Issue Briefs. World Nuclear Association. 2009. http://www.world-nuclear.org/info/inf02.html. Retrieved 2009-04-01.

- ^ Terry Macalister (10 April 2008). "Westinghouse wins first US nuclear deal in 30 years". London: The Guardian. http://www.guardian.co.uk/world/2008/apr/10/nuclear.nuclearpower. Retrieved 2008-04-09.

- ^ a b Steve Kidd (22 August 2008). "Escalating costs of new build: what does it mean?". Nuclear Engineering International. http://www.neimagazine.com/story.asp?sectioncode=147&storyCode=2050690. Retrieved 2008-08-30.

- ^ "Bruce Power New build Project Environmental Assessment — Round One Open House (Appendix B2)". Bruce Power. 2006. http://www.ceaa.gc.ca/050/documents/26586/26586E.pdf. Retrieved 2007-04-23.

- ^ Patel, Tara; Francois de Beaupuy (24 November 2010). "China Builds Nuclear Reactor for 40% Less Than Cost in France, Areva Says". Bloomberg. http://www.bloomberg.com/news/2010-11-24/china-builds-french-designed-nuclear-reactor-for-40-less-areva-ceo-says.html. Retrieved 2011-03-08.

- ^ "NuStart Energy Picks Enercon for New Nuclear Power Plant License Applications for a GE ESBWR and a Westinghouse AP 1000". PRNewswire. 2006. http://www.prnewswire.com/cgi-bin/stories.pl?ACCT=104&STORY=/www/story/01-11-2006/0004246911&EDATE=. Retrieved 2006-11-10.

- ^ "Costs and Benefits". The Canadian Nuclear FAQ. 2011. http://www.nuclearfaq.ca/cnf_sectionC.htm#darlington. Retrieved 2011-01-05.

- ^ Christian Parenti (April 18, 2011). "Nuclear Dead End: It's the Economics, Stupid". The Nation. http://www.thenation.com/article/159997/nuclear-dead-end-its-economics-stupid.

- ^ "NUREG-1350 Vol. 18: NRC Information Digest 2006-2007" (PDF). Nuclear Regulatory Commission. 2006. http://www.nrc.gov/reading-rm/doc-collections/nuregs/staff/sr1350/. Retrieved 2007-01-22.

- ^ a b c d What's behind the red-hot uranium boom, 2007-04-19, CNNMoney, Retrieved 2008-07-2

- ^ "UxC Nuclear Fuel Price Indicators (Delayed)". Ux Consulting Company, LLC. http://www.uxc.com/review/uxc_Prices.aspx. Retrieved 2008-07-02.

- ^ "The Economics of Nuclear Power". World Nuclear Association. May 2008. http://world-nuclear.org/info/inf02.html. Retrieved 2008-05-08.

- ^ "Frontline: Interview with Charles Till". 1995. http://www.pbs.org/wgbh/pages/frontline/shows/reaction/interviews/till.html. Retrieved 2011-10-31.

- ^ "Uranium resources sufficient to meet projected nuclear energy requirements long into the future". Nuclear Energy Agency (NEA). 3 June 2008. http://www.nea.fr/html/general/press/2008/2008-02.html. Retrieved 2008-06-16.

- ^ a b Benjamin K. Sovacool (January 2011). "Second Thoughts About Nuclear Power". National University of Singapore. pp. 5–6. http://www.spp.nus.edu.sg/docs/policy-briefs/201101_RSU_PolicyBrief_1-2nd_Thought_Nuclear-Sovacool.pdf.

- ^ Safe Transportation of Spent Nuclear Fuel, January 2003, The Center for Reactor Information, Retrieved 1 June 2007

- ^ a b "Waste Management". http://www.nuclearfaq.ca/cnf_sectionE.htm. Retrieved 2011-01-05.

- ^ Nuclear Engineering International

- ^ "Management of spent nuclear fuel and radioactive waste". Europa. SCADPlus. 2007-11-22. http://europa.eu/scadplus/leg/en/lvb/l27048.htm. Retrieved 2008-08-05.

- ^ Nuclear Energy Data 2008, OECD, p. 48 (the Netherlands, Borssele nuclear power plant)

- ^ Decommissioning a Nuclear Power Plant, 2007-4-20, U.S. Nuclear Regulatory Commission, Retrieved 2007-6-12

- ^ http://www.nrc.gov/reading-rm/doc-collections/news/2009/09-112.html

- ^ Koplow, Doug (February 2011). "Nuclear Power:Still Not Viable without Subsidies". Union of Concerned Scientists. p. 10. http://www.ucsusa.org/assets/documents/nuclear_power/nuclear_subsidies_report.pdf.

- ^ Koplow, Doug (February 2011). "Nuclear Power:Still Not Viable without Subsidies". Union of Concerned Scientists. p. 2. http://www.ucsusa.org/assets/documents/nuclear_power/nuclear_subsidies_report.pdf.

- ^ Nancy Folbre (March 28, 2011). "Renewing Support for Renewables". New York Times. http://economix.blogs.nytimes.com/2011/03/28/renewing-support-for-renewables/.

- ^ Antony Froggatt (4 April 2011). "Viewpoint: Fukushima makes case for renewable energy". BBC News. http://www.bbc.co.uk/news/world-asia-pacific-12960655.

- ^ Juergen Baetz (21 April 2011). "Nuclear Dilemma: Adequate Insurance Too Expensive". Associated Press. http://abcnews.go.com/Business/wireStory?id=13428045. Retrieved 21 April 2011.

- ^ http://www.cna.ca/english/pdf/nuclearfacts/19-NuclearFacts-insurance.pdf

- ^ Civil Liability for Nuclear Damage: WNA

- ^ Vienna Convention on Civil Liability for Nuclear Damage, IAEA, 12/11/1977

- ^ Press Communiqué 6 June 2003 - Revised Nuclear Third Party Liability Conventions Improve Victims' Rights to Compensation

- ^ a b Assumptions to the Annual Energy Outlook 2006 - see p.73

- ^ Severance, C. (2009) "Business Risks and Costs of New Nuclear Power"; for critiques and replies from the study's author, see http://climateprogress.org/2009/01/05/study-cost-risks-new-nuclear-power-plants/

- ^ (PDF) Update of the MIT 2003 Future of Nuclear Power Study. Massachusetts Institute of Technology. 2009. http://web.mit.edu/nuclearpower/pdf/nuclearpower-update2009.pdf. Retrieved 2009-05-18.

- ^ Benjamin K. Sovacool (2011). Contesting the Future of Nuclear Power: A Critical Global Assessment of Atomic Energy, World Scientific, p. 126.

- ^ "The Costs of Generating Electricity" (PDF). The Royal Academy of Engineering. 2004. http://www.countryguardian.net/generation_costs_report2.pdf. Retrieved 2006-11-10.

- ^ http://www.ukerc.ac.uk/ResearchProgrammes/TechnologyandPolicyAssessment/TPAProjectIntermittency.aspx UK Energy Research Council Report on effects of intermittent wind energy

- ^ http://www.claverton-energy.com/?dl_id=314

- ^ http://www.eia.doe.gov/oiaf/ieo/pdf/0484(2006).pdf Energy Information Administration, "International Energy Outlook", 2006, p. 66.

- ^ <Please add first missing authors to populate metadata.> (May 2008). Nuclear Power's Role in Generating Electricity. Congressional Budget Office. http://www.cbo.gov/ftpdocs/91xx/doc9133/05-02-Nuclear.pdf. Retrieved 2009-08-03

- ^ "Energy Analysis of Power Systems". Information and Issue Briefs. World Nuclear Association. 2006. http://www.world-nuclear.org/info/inf11.html. Retrieved 2006-11-10.

- ^ Wind ($23.37) v. Gas (25 Cents), Wall Street Journal, May 12, 2008

- ^ Koplow, Doug (February 2011). "Nuclear Power:Still Not Viable without Subsidies". Union of Concerned Scientists. p. 1. http://www.ucsusa.org/assets/documents/nuclear_power/nuclear_subsidies_report.pdf.

- ^ Benjamin K. Sovacool (January 2011). "Second Thoughts About Nuclear Power". National University of Singapore. p. 4. http://www.spp.nus.edu.sg/docs/policy-briefs/201101_RSU_PolicyBrief_1-2nd_Thought_Nuclear-Sovacool.pdf.

- ^ Jon Palfreman. "Why the French Like Nuclear Power". Frontline. Public Broadcasting Service. http://www.pbs.org/wgbh/pages/frontline/shows/reaction/readings/french.html. Retrieved 2006-11-10.

- ^ http://www.climatesceptics.org/company/costs-for-nuclear-increase

- ^ Charles D. Ferguson (April 2007). "Nuclear Energy: Balancing Benefits and Risks" (PDF). Council on Foreign Relations. http://www.cfr.org/content/publications/attachments/NuclearEnergyCSR28.pdf. Retrieved 2008-05-08.

- ^ http://www.claverton-energy.com/nuclear-power-stations-cant-load-follow-that-much-official.html

- ^ http://www.cessa.eu.com/sd_papers/wp/wp2/0203_Pouret_Nuttall.pdf

- ^ http://areva.com/EN/global-offer-419/mediashare-1070/video/page.html?xtor=AD-71

- ^ Steve Kidd (3 March 2009). "New nuclear build – sufficient supply capability?". Nuclear Engineering International. http://www.neimagazine.com/story.asp?sectioncode=147&storyCode=2052302. Retrieved 2009-03-09.

- ^ http://www.doosanheavy.com/eng/2/sub2_01_21.htm

- ^ Nuclear power and water scarcity, ScienceAlert, 28 October 2007, Retrieved 2008-08-08

- ^ $40 Billion boost for nuclear power in Russia Russia Today Retrieved on July 31, 2008

- ^ "New nuclear plants get go-ahead". BBC. 2008-01-10. http://news.bbc.co.uk/2/hi/uk_news/politics/7179579.stm. Retrieved 2008-01-10.

- ^ BBC's UK Electricity Calculator illustrates new nuclear role to meet future demand. http://news.bbc.co.uk/2/shared/spl/hi/uk/06/electricity_calc/html/1.stm

- ^ International Atomic Energy Agency (2011). "Power Reactor Information System". IAEA. http://www.iaea.org/programmes/a2/.

- ^ "World Nuclear Power Reactors & Uranium Requirements". World Nuclear Association (WNA). 6 February 2011. http://www.world-nuclear.org/info/reactors.html. Retrieved 2011-02-15.

- ^ Suga, Masumi; Shunichi Ozasa (September 7, 2009). "China to Build More Nuclear Plants, Japan Steel Says". Bloomberg.com. http://www.bloomberg.com/apps/news?pid=20601101&sid=a2lUkzmYNGWI. Retrieved 2011-02-15.

- ^ "China Should Control Pace of Reactor Construction, Outlook Says". Bloomberg News. January 11, 2011. http://www.bloomberg.com/news/2011-01-11/china-should-control-pace-of-reactor-construction-outlook-says.html.

- ^ http://www.eref-europe.org/dls/pdf/2007/eref_pr_260907.pdf EREF EREF deplores COFACE state aid decision of the European Commission in the case of nuclear power support, September 2007

- ^ http://www.energyprobe.org/energyprobe/images/NuclearCost/NuclearCost_files/frame.htm Energy Probe, "Critique of the Official View of Ontario's Energy Future", Presentation to the Canadian Academy of Engineering, June 2007.

- ^ Mycle Schneider, Steve Thomas, Antony Froggatt, Doug Koplow (August 2009). The World Nuclear Industry Status Report 2009 Commissioned by German Federal Ministry of Environment, Nature Conservation and Reactor Safety, p. 7.

- ^ http://www.elfi.fi/fi/lehdistotiedotteet/olkiluoto-3-n-myohastyminen-tulee-kalliiksi-pohjoismaisille-sahkonkaytta-2.html ELFI press release, September 2007

- ^ GE Hitachi (2008). "Advanced Boiling Water Reactor (ABWR) Fact Sheet". http://www.gepower.com/prod_serv/products/nuclear_energy/en/downloads/gea14576e_abwr.pdf. Retrieved 2011-03-07.

- ^ "S. Korea to Build 12 More Nuclear Reactors by 2022". The Korea Times. 2008-12-28. http://www.koreatimes.co.kr/www/news/biz/2010/04/123_36846.html. Retrieved 2011-03-08.

- ^ Tony Halpin (2007-04-17). "Floating nuclear power stations raise spectre of Chernobyl at sea". The Times Online. http://www.timesonline.co.uk/tol/news/world/europe/article1662889.ece. Retrieved 2011-03-07.

- ^ Andrew England, Peggy Hollinger, Song Jung-a. "S. Koreans win $20B UAE nuclear power contract". Financial Times (CNN). Archived from the original on 2010-01-14. http://replay.waybackmachine.org/20100114064741/http://www.cnn.com/2009/BUSINESS/12/28/skorea.nuclear.uae.ft/index.html.

- ^ "Gauging the pressure". The Economist. 28 April 2011. http://www.economist.com/node/18621367?story_id=18621367. Retrieved 3 May 2011.

- ^ Eileen O'Grady. Entergy says nuclear remains costly Reuters, May 25, 2010.

- ^ Terry Ganey. AmerenUE pulls plug on project Columbia Daily Tribune, April 23, 2009.

- ^ Stephanie Cooke (October 10, 2011). "After Fukushima, Does Nuclear Power Have a Future?". New York Times. http://www.nytimes.com/2011/10/11/business/energy-environment/after-fukushima-does-nuclear-power-have-a-future.html.

- ^ Matthew L. Wald (December 7, 2010). Nuclear ‘Renaissance’ Is Short on Largess The New York Times.

- ^ "Team France in disarray: Unhappy attempts to revive a national industry". The Economist. December 2, 2010. http://www.economist.com/node/17627569.

- ^ Matthew L. Wald. (September 23, 2010). "Aid Sought for Nuclear Plants". Green. The New York Times. http://green.blogs.nytimes.com/2010/09/23/aid-sought-for-nuclear-plants/.

External links

- The Economics of Nuclear Power, World Nuclear Association, April 2010.

- The Economics of Nuclear Power: An Update report by Steve Thomas, Heinrich Böll Foundation, March 2010.

- The Economics of Nuclear Reactors: Renaissance or Relapse? report by Mark Cooper, Vermont Law School, 2009.

- The Nuclear Illusion report by Amory Lovins, Chief Scientist, Rocky Mountain Institute, 2008.

- "The Economics of Nuclear Power: analysis of recent studies", Steve Thomas, PSIRU, University of Greenwich, July 2005

- The Political Economy of Nuclear Energy in the United States, Brookings Institution, September 2004

Categories:- Nuclear power stations

- Electricity economics

Wikimedia Foundation. 2010.