- VIX

-

For other uses, see Vix (disambiguation).

VIX is the ticker symbol for the Chicago Board Options Exchange Market Volatility Index, a popular measure of the implied volatility of S&P 500 index options. Often referred to as the fear index or the fear gauge, it represents one measure of the market's expectation of stock market volatility over the next 30 day period. The VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the next 30-day period, which is then annualized. The VIX Index was developed by Prof. Robert E. Whaley in 1993 and is a registered trademark of the CBOE.[1]

Contents

Specifications

The VIX is calculated and disseminated in real-time by the Chicago Board Options Exchange. It is a weighted blend of prices for a range of options on the S&P 500 index. On March 26, 2004, the first-ever trading in futures on the VIX Index began on CBOE Futures Exchange (CFE). As of February 24, 2006, it became possible to trade VIX options contracts. A few Exchange Traded Funds seek to track its performance. The formula uses a kernel-smoothed estimator that takes as inputs the current market prices for all out-of-the-money calls and puts for the front month and second month expirations.[2] The goal is to estimate the implied volatility of the S&P 500 index over the next 30 days.

The VIX is the square root of the par variance swap rate for a 30 day term initiated today. Note that the VIX is the volatility of a variance swap and not that of a volatility swap (volatility being the square root of variance). A variance swap can be perfectly statically replicated through vanilla puts and calls whereas a volatility swap requires dynamic hedging. The VIX is the square-root of the risk neutral expectation of the S&P 500 variance over the next 30 calendar days. The VIX is quoted as an annualized standard deviation.

The VIX has replaced the older VXO as the preferred volatility index used by the media. VXO was a measure of implied volatility calculated using 30-day S&P 100 index at-the-money options.

Interpretation

The VIX is quoted in percentage points and translates, roughly, to the expected movement in the S&P 500 index over the next 30-day period, which is then annualized. For example, if the VIX is 15, this represents an expected annualized change of 15% over the next 30 days; thus one can infer that the index option markets expect the S&P 500 to move up or down 15%/√12 = 4.33% over the next 30-day period.[3] That is, index options are priced with the assumption of a 68% likelihood (one standard deviation) that the magnitude of the S&P 500's 30-day return will be less than 4.33% (up or down).

The price of call options and put options can be used to calculate implied volatility, because volatility is one of the factors used to calculate the value of these options. Higher (or lower) volatility of the underlying security makes an option more (or less) valuable, because there is a greater (or smaller) probability that the option will expire in the money (i.e., with a market value above zero). Thus, a higher option price implies greater volatility, other things being equal.

Even though the VIX is quoted as a percentage rather than a dollar amount there are a number of VIX-based derivative instruments in existence, including:

- VIX futures contracts, which began trading in 2004

- exchange-listed VIX options, which began trading in February 2006.

- VIX futures based exchange-traded notes and exchange-traded funds, such as:

- S&P 500 VIX Short-Term Futures ETN (NYSE: VXX) and S&P 500 VIX Mid-Term Futures ETN (NYSE: VXZ) launched by Barclays iPath in February 2009.

- S&P 500 VIX ETF (LSE: VIXS) launched by Source UK Services in June 2010.

- VIX Short-Term Futures ETF (NYSE: VIXY) and VIX Mid-Term Futures ETF (NYSE: VIXM) launched by ProShares in January 2011.

Similar indices for bonds include the MOVE, LBPX indices.

Although the VIX is often called the "fear index", a high VIX is not necessarily bearish for stocks. Instead, the VIX is a measure of market perceived volatility in either direction, including to the upside. In practical terms, when investors anticipate large upside volatility, they are unwilling to sell upside call stock options unless they receive a large premium. Option buyers will be willing to pay such high premiums only if similarly anticipating a large upside move. The resulting aggregate of increases in upside stock option call prices raises the VIX just as does the aggregate growth in downside stock put option premiums that occurs when option buyers and sellers anticipate a likely sharp move to the downside. When the market is believed as likely to soar as to plummet, writing any option that will cost the writer in the event of a sudden large move in either direction may look equally risky. Hence high VIX readings mean investors see significant risk that the market will move sharply, whether downward or upward. The highest VIX readings occur when investors anticipate that huge moves in either direction are likely. Only when investors perceive neither significant downside risk nor significant upside potential will the VIX be low.

The Black-Scholes formula uses a model of stock price dynamics to estimate how an option’s value depends on the volatility of the underlying assets.

Criticism

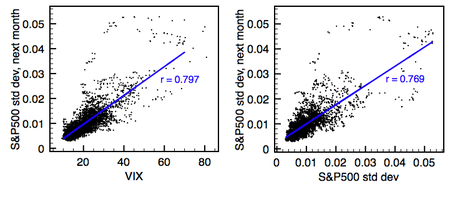

Performance of VIX (left) compared to past volatility (right) as 30-day volatility predictors, for the period of Jan 1990-Sep 2009. Volatility is measured as the standard deviation of S&P500 one-day returns over a month's period. The blue lines indicate linear regressions, resulting in the correlation coefficients r shown. Note that VIX has virtually the same predictive power as past volatility, insofar as the shown correlation coefficients are nearly identical. From Artur Adib's Blog.

Performance of VIX (left) compared to past volatility (right) as 30-day volatility predictors, for the period of Jan 1990-Sep 2009. Volatility is measured as the standard deviation of S&P500 one-day returns over a month's period. The blue lines indicate linear regressions, resulting in the correlation coefficients r shown. Note that VIX has virtually the same predictive power as past volatility, insofar as the shown correlation coefficients are nearly identical. From Artur Adib's Blog.

VIX has received the same criticism as many other volatility forecasting models: Despite its sophisticated composition, the predictive power of VIX is similar to that of plain-vanilla measures, such as simple past volatility. The body of work dedicated to volatility forecasting models is overwhelming. Thousands of academics have devoted their entire careers to publishing models that supposedly are able to forecast volatility. Some authors have published well over 40 papers on this very topic[4], and yet none seems to deliver any improvement over the simple standard deviation.[5][6] Prof. Torben Andersen has fiercely attacked skeptics in a number of papers. In Answering the Critics: Yes, ARCH models do provide good volatility forecasts, Profs. Andersen and Bollerslev attack the work of leading researchers such as Cumby, Figlewski, Hasbrouck, Jorion among many others, arguing that they do not know how to correctly implement their models.[7] In Answering the Skeptics: Yes, Standard Volatility Models Do Provide Accurate Forecasts, Profs. Andersen and Bollerslev again repeat their attack on those who apply Occam's Razor to dismiss volatility forecasting models. It is interesting to note that while critics are publishing their papers in top journals such as Journal of Finance, Journal of Derivatives, Journal of Portfolio Management, etc. those defending their volatility forecasting models or criticizing skeptics have been unable to publish their work in journals of similar prestige, in many cases opting for leaving them unpublished, as working papers.[8][original research?]

Besides this controversy between believers in volatility forecasting models and the large majority of skeptics, there is a contentious battle among those same believers, one claiming that his model is superior to the rest. In August 2008, Prof. Torben Andersen and Prof. Oleg Bondarenko once again surprised the academic community by claiming not only that their volatility forecasting model was superior, but that they have mathematically demonstrated that future research was futile, since no future volatility forecasting model can beat theirs[9].

In an interview regarding their CIV model, Andersen and Bondarenko go as far as to assert[10] The best possible market-based implied volatility measure for volatility prediction may take the form of a corridor implied volatility (CIV) measure.Removed from this controversy, practitioners and portfolio managers seem to completely ignore or dismiss volatility forecasting models. For example, Nassim Taleb famously titled one of his Journal of Portfolio Management papers We Don't Quite Know What We are Talking About When We Talk About Volatility.[11] Nassim Taleb gained worldwide recognition though his Black swan theory, which argues the silliness of trying to predict the unpredictable.

History

Here is a timeline of some key events in the history of the VIX Index:

- 1993 - The VIX Index was introduced in a paper by Professor Robert E. Whaley at Vanderbilt University.[12]

- 2003 - Revised, more robust methodology for the VIX Index was introduced. The underlying index is changed from the CBOE S&P 100 Index (OEX) to the CBOE S&P 500 Index (SPX).

- 2004 - On March 26, 2004, the first-ever trading in futures on the VIX Index began on the CBOE Futures Exchange (CFE).

- 2006 - VIX options were launched in February 2006.

- 2008 - On October 24, 2008, the VIX reached an intraday high of 89.53.

Between 1990 and October 2008, the average value of VIX was 19.04.

In 2004 and 2006, VIX Futures and VIX Options, respectively, were named Most Innovative Index Product at the Super Bowl of Indexing Conference.[13]

See also

- VIX Charting - Implied and Historical Volatility

- Stock market bottom

- IVX

- CBOE

References

- ^ ^1 http://www.cboe.com/micro/VIX/vixintro.aspx

- ^ "VIX White Paper" (PDF). http://www.cboe.com/micro/vix/vixwhite.pdf. Retrieved 2010-09-20.

- ^ Note that the divisor is √12, not 12. See the definition volatility for a discussion of computing inter-period volatility.

- ^ http://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=17696 Torben Andersen's 40 papers on volatility

- ^ Cumby, R., S. Figlewski and J. Hasbrouck (1993), "Forecasting Volatility and Correlations with EGARCH models", Journal of Derivatives, Winter, 51-63

- ^ Jorion, P. (1995), "Predicting Volatility in Foreign Exchange Market", Journal of Finance, 50, 507-528

- ^ http://www.nber.org/papers/w6023 Torben Andersen's attack on Cumby, Figlewski, Hasbrouck, Jorion among many others

- ^ http://ssrn.com/abstract=226433 Example of working paper attacking volatility forecast skeptics

- ^ http://www.nber.org/papers/w13449 Andersen and Bondarenko's paper, in which they claim superiority over other volatility forecasting models

- ^ http://insight.kellogg.northwestern.edu/index.php/Kellogg/article/the_vix_civ_and_mfiv

- ^ http://papers.ssrn.com/sol3/papers.cfm?abstract_id=970480 We Don't Quite Know What We are Talking About When We Talk About Volatility

- ^ Robert E. Whaley (2008). "Understanding VIX". http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1296743.

- ^ "Index Product Awards". https://indexbusinessassociation.org/resources_and_research/industry_awards.htm. Retrieved 2008-01-05.

Bibliography

- Black, Keith H. "Improving Hedge Fund Risk Exposures by Hedging Equity Market Volatility, or How the VIX Ate My Kurtosis." The Journal of Trading. (Spring 2006).

- Connors, Larry. "A Volatile Idea." Futures (July 1999): p. 36—37.

- Connors, Larry. "Timing Your S&P Trades with the VIX." Futures (June 2002): pp. 46—47.

- Copeland, Maggie. "Market Timing: Style and Size Rotation Using the VIX." Financial Analysts Journal, (Mar/Apr 1999); pp. 73—82.

- Daigler, Robert T., and Laura Rossi. "A Portfolio of Stocks and Volatility." The Journal of Investing. (Summer 2006).

- Moran, Matthew T., "Review of the VIX Index and VIX Futures.," Journal of Indexes, (October/November 2004). pp. 16 — 19.

- Moran, Matthew T. and Srikant Dash. "VIX Futures and Options: Pricing and Using Volatility Products to Manage Downside Risk and Improve Efficiency in Equity Portfolios." The Journal of Trading. Summer 2007).

- Szado, Ed. "VIX Futures and Options—A Case Study of Portfolio Diversification During the 2008 Financial Crisis." (June 2009).

- Tan, Kopin. "The ABCs of VIX." Barron's (Mar 15, 2004): p. MW16.

- Tracy, Tennille. "Trading Soars on Financials As Volatility Index Hits Record." Wall Street Journal. (Sept. 30, 2008) pg. C6.

- Whaley, Robert E., "Derivatives on Market Volatility: Hedging Tools Long Overdue," Journal of Derivatives 1 (Fall 1993), pp. 71—84.

- Whaley, Robert E. "Understanding the VIX." The Journal of Portfolio Management (Spring 2009).

External links

Volatility Modelling volatility Trading volatility Volatility arbitrage · Straddle · Volatility swap · IVX · VIX

Categories:- Index numbers

- Derivatives (finance)

- Mathematical finance

Wikimedia Foundation. 2010.